Anyone have an opinion on international funds? When I started investing yrs ago, was told holding international funds was a way to avoid being totally dependant on the US economy and to "smooth the ride" when US economy was down (assuming international markets are then up). But the current expense ratio for my international funds is a little high, so was considering moving that money elsewhere.

Logging in...

Opinions about International Mutual Funds?

Collapse

X

-

Truth is, most major, publicly-traded companies in the U.S. and overseas are "international": Toyota isn't any more international than GM. Bayer isn't any more international than Eli Lily. Airbus isn't any more international than Boeing. That certainly wasn't always the case.

All such companies are now a part of a global economy, and generally speaking, as goes the U.S. economy, so goes the rest of the world's.

-

-

I hold 10% of my stock portfolio in FSIVX, a Fidelity international stock index fund. I hold it because the U.S. market and International market are not completely correlated. It is doing better than my U.S. total stock market fund over the past 12 months.

Comment

-

-

That's not the point, though.Originally posted by TexasHusker View PostTruth is, most major, publicly-traded companies in the U.S. and overseas are "international": Toyota isn't any more international than GM. Bayer isn't any more international than Eli Lily. Airbus isn't any more international than Boeing. That certainly wasn't always the case.

All such companies are now a part of a global economy, and generally speaking, as goes the U.S. economy, so goes the rest of the world's.

The US only makes up about 24% of the total worldwide stock market capitalization. So if you only invest in US stocks, you are missing 76% of the world market.

Toyota may not be any more international than GM but it is a foreign company. It's part of that other 76%.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

My point was, as the U.S economy goes, so goes the world's: There is no such thing as a U.S. recession without an ensuing worldwide recession. There are several reasons for such, but that is a subject for another day.Originally posted by disneysteve View PostThat's not the point, though.

The US only makes up about 24% of the total worldwide stock market capitalization. So if you only invest in US stocks, you are missing 76% of the world market.

Toyota may not be any more international than GM but it is a foreign company. It's part of that other 76%.

Comment

-

-

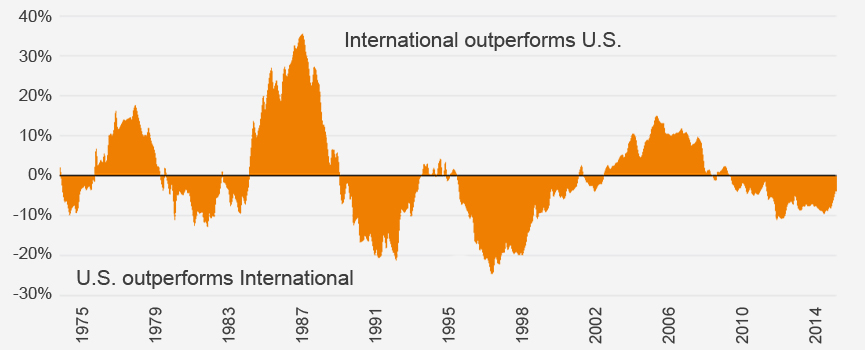

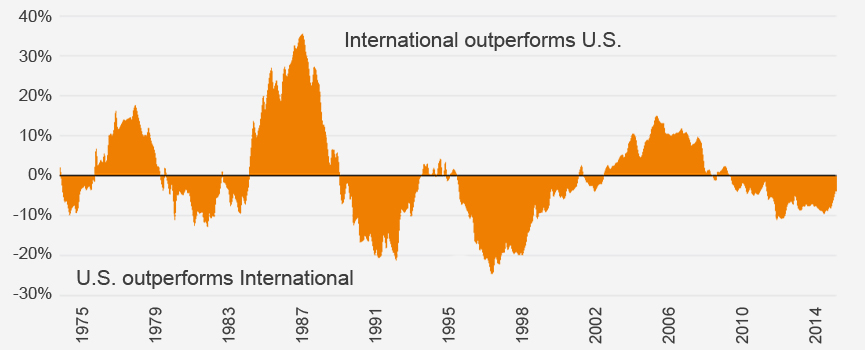

Do you have any data to back that up? I have data that show you're wrong.Originally posted by TexasHusker View PostMy point was, as the U.S economy goes, so goes the world's: There is no such thing as a U.S. recession without an ensuing worldwide recession. There are several reasons for such, but that is a subject for another day.

Comment

-

-

Your data isn't related to economic expansions or recessions - only of stock prices for companies arbitrarily labeled "domestic" or "international."Originally posted by corn18 View PostDo you have any data to back that up? I have data that show you're wrong.

It all depends on one's criteria for labeling a company "domestic" or "international".

Is s company international because their headquarters is in London? Is it international because a certain percentage of its customers are outside the US? North America?

In terms of worldwide trade, practically all Fortune 500 companies do so any more.

Comment

-

-

I think the common definition of a foreign company is a company based outside of the US. You mentioned some large multinational companies like Toyota or Bayer but there are also plenty of companies that aren't common household names in the US because they primarily operate in their home country. A telecom provider or utility company would be good examples of that. That's part of what you are missing if you don't invest in international holdings.Originally posted by TexasHusker View PostIs s company international because their headquarters is in London?

I also disagree that they all perform in lockstep with the US economy.

I just looked at the Fortune Global 500, http://fortune.com/global500/, the world's 500 largest companies. Four of the top 5 and 6 of the top 10 are foreign companies.

If you aren't investing internationally, you're missing a huge chunk of the market.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

Are there other international funds, with lower expense ratios, available to you?Originally posted by cinfooya View PostAnyone have an opinion on international funds? When I started investing yrs ago, was told holding international funds was a way to avoid being totally dependant on the US economy and to "smooth the ride" when US economy was down (assuming international markets are then up). But the current expense ratio for my international funds is a little high, so was considering moving that money elsewhere.

Comment

-

-

I would think the typical balanced mutual fund has that base covered by your definition.Originally posted by disneysteve View PostI think the common definition of a foreign company is a company based outside of the US. You mentioned some large multinational companies like Toyota or Bayer but there are also plenty of companies that aren't common household names in the US because they primarily operate in their home country. A telecom provider or utility company would be good examples of that. That's part of what you are missing if you don't invest in international holdings.

I also disagree that they all perform in lockstep with the US economy.

I just looked at the Fortune Global 500, http://fortune.com/global500/, the world's 500 largest companies. Four of the top 5 and 6 of the top 10 are foreign companies.

If you aren't investing internationally, you're missing a huge chunk of the market.

Comment

-

-

If you are invested in global funds, sure, then this conversation is moot. I don't think OP is, though, or else why ask the question? If you are only in domestic funds like an S&P 500 index or a total US stock market index, you probably don't have that foreign exposure.Originally posted by TexasHusker View PostI would think the typical balanced mutual fund has that base covered by your definition.

That's why the 3-fund portfolio many people tout is total US stock index, total foreign stock index , and total bond index.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

Sure - index and mutual funds are two different animals - perhaps I misunderstood. Since funds generally appeal to a much more "cruise control" investment strategy, were I in that boat, I'd pick a balanced fund with low expenses and a good return history and call it good. Such a fund will give you exposure to foreign, domestic, natural resources, small, medium, and large cap, and even treasuries and bonds.Originally posted by disneysteve View PostIf you are invested in global funds, sure, then this conversation is moot. I don't think OP is, though, or else why ask the question? If you are only in domestic funds like an S&P 500 index or a total US stock market index, you probably don't have that foreign exposure.

That's why the 3-fund portfolio many people tout is total US stock index, total foreign stock index , and total bond index.

Comment

-

-

The question was about mutual funds, not economies. While investing in a U.S. stock market mutual fund will expose you to international economics, it will not get you into companies outside the U.S. Your argument is circular.Originally posted by TexasHusker View PostYour data isn't related to economic expansions or recessions - only of stock prices for companies arbitrarily labeled "domestic" or "international."

It all depends on one's criteria for labeling a company "domestic" or "international".

Is s company international because their headquarters is in London? Is it international because a certain percentage of its customers are outside the US? North America?

In terms of worldwide trade, practically all Fortune 500 companies do so any more.

Comment

-

-

ok. My point was, with a global economy, where a company is physically domiciled is irrelevant any more.Originally posted by corn18 View PostThe question was about mutual funds, not economies. While investing in a U.S. stock market mutual fund will expose you to international economics, it will not get you into companies outside the U.S. Your argument is circular.

Comment

-

Comment