Originally posted by Leo

View Post

Logging in...

Gamestop

Collapse

X

-

Well, I'm not planning to hold til the very end. I'm watching it, and we'll see in few days.

Same thing is happening every after market hours. I still have some gains though.

Like I said, this is not investing. Just joined for fun and if I end up not losing my money, then great, I will have a new laptop that I don't need.

Comment

-

-

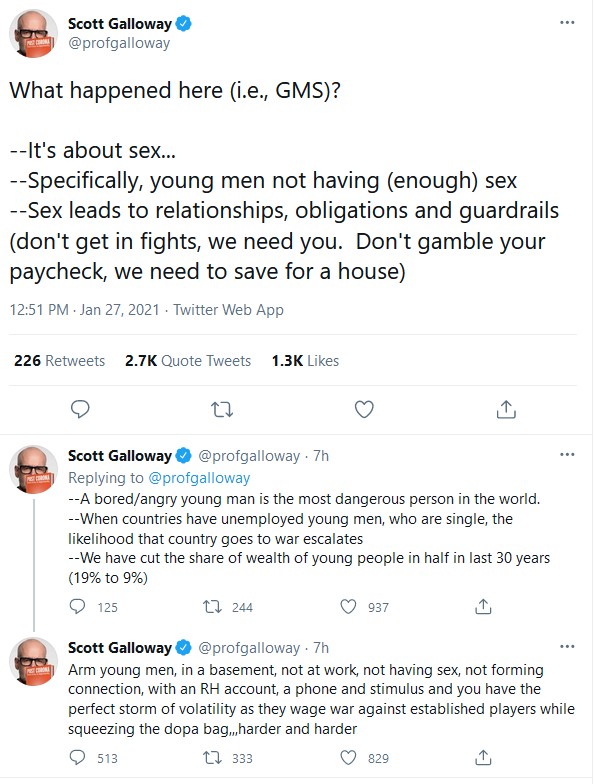

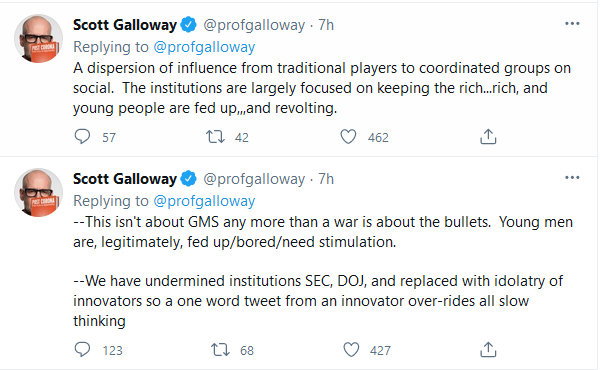

I like Scott Galloway's explanation of whats going on.

james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

You going to sell @ $440?Originally posted by Leo View PostWell, I'm not planning to hold til the very end. I'm watching it, and we'll see in few days.

Same thing is happening every after market hours. I still have some gains though.

Like I said, this is not investing. Just joined for fun and if I end up not losing my money, then great, I will have a new laptop that I don't need.

Comment

-

-

No, this event is funny. I'm watching it though, my 1k is still okay.

Robinhood just removed Gamestop and prevents anyone from buying stocks like Gamestop or AMC. It's crazy that they can do that. Something is really up. People from Reddit says someone must be really scared, maybe the entire Wallstreet? Looks like people are still holding against the shorts.

Comment

-

-

This irritates me!!! I just bought AMC at 20, and then they announce that trading is restricted and the price drops! And I am losing money because the powers that be support the jerks that are shorting? No no, it doesn't work that way, I wonder if we can file a class action suit against the brokers? You can't change the rules in the middle of the game without SEC or other entities that change laws for everyone!

UPDATE: GameStop and AMC trading restricted by TD Ameritrade, Schwab, Robinhood others

10:40 am ET January 28, 2021 (MarketWatch)

Print

By Mark DeCambre

'We do not believe this situation will subside until the exchanges and regulators halt or put certain symbols into liquidation only,' said Interactive Brokers on Thursday

Some major brokerage houses have begun to respond to a frenetic surge in the price of shares of certain companies that has been attributed to rabid buying by individual investors inspired by social-media platforms.

On Wednesday, TD Ameritrade said it was restricting trading in GameStop(GME) and AMC Entertainment Holdings(AMC), along with other names, amid a triple-digit percentage surge in the price of those companies in recent days.

"In the interest of mitigating risk for our company and clients, we have put in place several restrictions on some transactions in $GME, $AMC and other securities," a spokeswoman for TD Ameritrade told MarketWatch, referring to the ticker symbols of the companies. "We made these decisions out of an abundance of caution amid unprecedented market conditions and other factors."

Charles Schwab, which bought TD Ameritrade but operates it as an independent retail brokerage, said that it has tightened margin requirements in some of those stocks, including GameStop.

A Schwab spokeswoman said that the platform changed its margin requirements, limiting how much an investor can borrow, on Jan. 13 and said it has placed "restrictions in place on certain transactions in GME and other securities."

On Thursday, Interactive Brokers Group (https://cts.businesswire.com/ct/CT?id=smartlink&url=http%3A%2F%2Fwww.interactivebr okers.com%2F&esheet=52369556&newsitemid=2021012800 5689&lan=en-US&anchor=Interactive+Brokers+Group&index=1&md5=8 e 527dd84e4d46012dbb5ce2a08ad471)(IBKR) announced that as of midday Wednesday (https://www.businesswire.com/news/ho...Traded-Symbols), it put GameStop, AMC, BlackBerry Limited (BB.T) , retailer Express Ltd.(EXPR), and Koss Corp.(KOSS) option trading into liquidation only due to the extraordinary volatility in the markets. Meaning investors could only unwind their positions, not create new ones.

"In addition, long stock positions will require 100% margin and short stock positions will require 300% margin until further notice," the brokerage said.

"We do not believe this situation will subside until the exchanges and regulators halt or put certain symbols into liquidation only. We will continue to monitor market conditions and may add or remove symbols as may be warranted."

The restrictive moves come as shares of videogame retailer GameStock have shot up 1,600% in January, as traders gathering in online chat forums have gone on to take large bets on the stock using options, often out-of-the-money calls that pay off only if the stock rises in value over a set period.

Traders on sites like Reddit's WallStreetBets, and using trading platforms including Robinhood (which in its initial conception was meant to be a social platform organized around the trading of stocks), have clashed with hedge-fund investors, sparking a battle between prominent Wall Street short sellers and individual investors in GameStop shares.

See:Your guide to the lingo on the Reddit forum fueling GameStop's rise and over half of working mothers say their job performance has slipped during the pandemic (https://www.marketwatch.com/story/yo...more_headlines)

A Robinhood spokeswoman said that officials at the trading platform "continuously monitor the markets and adjust as we feel necessary for the benefit of our customers."

Robinhood said it also moved raised requirements for GameStop and AMC to 100%, emphasizing that Robinhood doesn't allow shorting of equities or allow customers to trade naked options.

However, the recent run-up in GameStop, and AMC Entertainment, has been spilling over into other areas of the market, with the likes of Bed Bath & Beyond (BBBY) and retailer Express Inc. rocketing on Wednesday.

Read: It isn't just GameStop: Here are some of the other heavily shorted stocks shooting higher (https://www.marketwatch.com/story/he...=mw_latestnews)

News alert:Outsized stock-market movers: AMC, up 225%; Express, up 140%; GameStop, up 88% (https://www.marketwatch.com/tools/mu...,spx,comp,djia)

Recent volatile trade has made some on Wall Street uneasy, with worries of a rapidly inflating bubble. The Dow Jones Industrial Average , the S&P 500 index and the Nasdaq Composite Index were all trading lower on Wednesday.

Regulators have been mindful of the recent action, with William Galvin, Massachusetts's secretary of the commonwealth, telling Barron's in an exclusive statement on Tuesday (https://www.barrons.com/articles/gam...05870?mod=mktw) that he was watching the action play out.

"This is certainly on my radar," Galvin said. "I'm concerned, because it suggests that there is something systemically wrong with the options trading on this stock."

-Mark DeCambre; 415-439-6400; AskNewswires@dowjones.com

(END) Dow Jones Newswires

January 28, 2021 10:40 ET (15:40 GMT)Last edited by jeffmem; 01-28-2021, 06:48 AM.

Comment

-

-

I had it yesterday at 15 sold at 16. Decided to buy again as I think shorts are still going to be squeezed. Then, now, I see this news that the suits are calling the shots at the brokerage firms to limit trades because they are losing money which I think is ridiculous. I think AMC was going over 30 for sure, but now..... Yeah I am losing a bit. It is trying to climb back, but they have limited it way too much. I made money on GME, and I may sell AMC for the balance if and when it can reach, it's almost there. But it's all BS. The brokers need to be sued, and I think something will be coming as others, like me, are now losing money because of their illegal actions.

Comment

-

-

So the casino changed the rules.Originally posted by jeffmem View PostI had it yesterday at 15 sold at 16. Decided to buy again as I think shorts are still going to be squeezed. Then, now, I see this news that the suits are calling the shots at the brokerage firms to limit trades because they are losing money which I think is ridiculous. I think AMC was going over 30 for sure, but now..... Yeah I am losing a bit. It is trying to climb back, but they have limited it way too much. I made money on GME, and I may sell AMC for the balance if and when it can reach, it's almost there. But it's all BS. The brokers need to be sued, and I think something will be coming as others, like me, are now losing money because of their illegal actions.

Comment

-

-

As far as I know they cannot do that without the government's approval, and as far as I know the government has not made a change to the regulations. Thus... it's an illegal move. I'm not griping about the little bit of dough I may lose, but this sets up a very bad precedent that brokers can call the shots at the tug of a shirt from a suit. They need to be sued now.Originally posted by corn18 View Post

So the casino changed the rules.

Comment

-

-

It looks like they started going after American Airlines too. I actually own that. I bought it back in March when everything tanked. It's up since I bought it but I guess I need to keep a close watch on it today. If it does shoot up, I might have to get out.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

I agree.Originally posted by jeffmem View Post

As far as I know they cannot do that without the government's approval, and as far as I know the government has not made a change to the regulations. Thus... it's an illegal move. I'm not griping about the little bit of dough I may lose, but this sets up a very bad precedent that brokers can call the shots at the tug of a shirt from a suit. They need to be sued now.

Comment

-

Comment