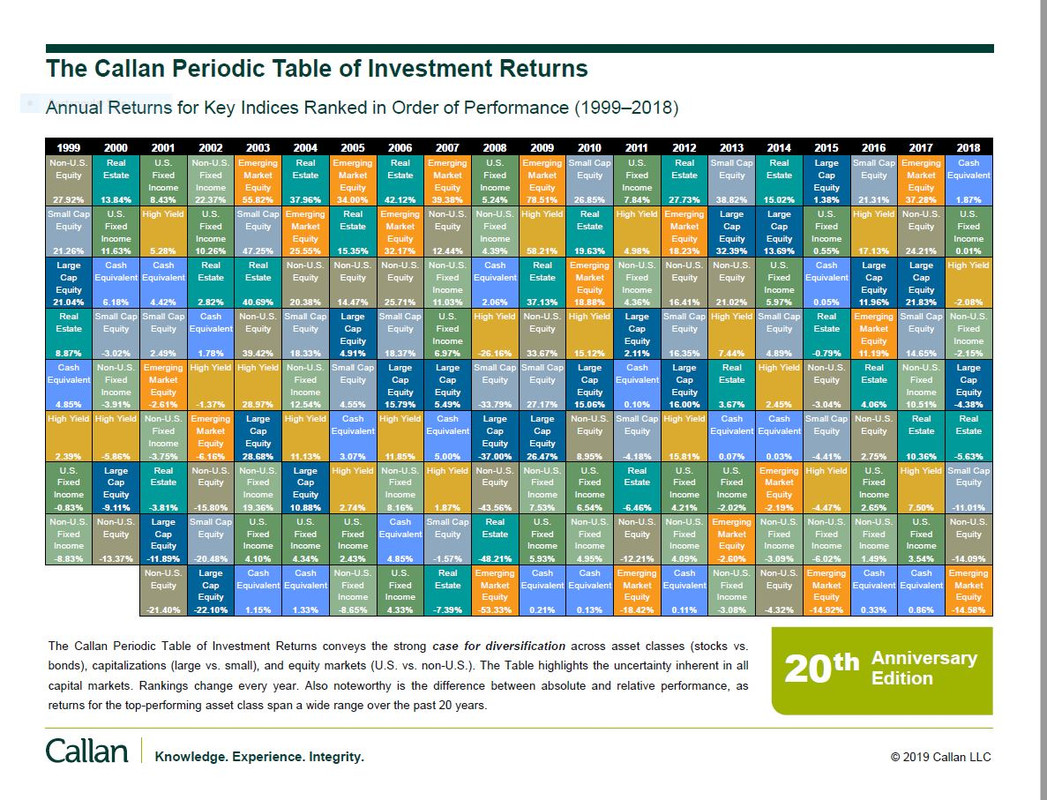

This is an interesting table. Cash was king overall in 2018. Real estate is a consistent winner with one year of trouble.

Logging in...

The Callan Periodic Table of Investment Returns

Collapse

X

-

The Callan Periodic Table of Investment Returns

Tags: None

-

-

That visually emphasizes the year to year changeability, but I found myself mentally turning it back into line graphs, one category at a time.

As an aside, "periodic table" is a cute name, but it really is more of an anti-periodic table because no characteristics are demonstrated to be to be predictable. But an exciting new element was discovered in 2001!"There is some ontological doubt as to whether it may even be possible in principle to nail down these things in the universe we're given to study." --text msg from my kid

"It is easier to build strong children than to repair broken men." --Frederick Douglass

Comment

-

-

I think it's really interesting that Large Cap US Equities only topped the chart once in 20 years and only top 2 spots in 3 of 20 years, yet that's the first thing most people think of when they are investing. However, Small Cap and Foreign Equities hold 8 top 2 spots. Most people don't put nearly enough in those areas probably because they feel large caps - big name companies we all know - are safer. Of course, "safer" often equals lower risk and lower return.

Also, for all the people who think they don't need any bonds in their portfolio if they are younger, US Fixed Income took the #1 or #2 spot in 7 out of 20 years. This is why everyone should probably have some stake in bonds, even if you're in your 20s or 30s. In the past 20 years, that part of your allocation would have come out at or near the top about 1/3 of the time, helping to balance out down years in the equity market.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

Bond bull markets and equity bull markets don't necessarily have an inverse relationship. That is, an equities bear does not necessarily mean a bond bull. You can lose your shirt trading bonds. I've done it.Originally posted by disneysteve View PostI think it's really interesting that Large Cap US Equities only topped the chart once in 20 years and only top 2 spots in 3 of 20 years, yet that's the first thing most people think of when they are investing. However, Small Cap and Foreign Equities hold 8 top 2 spots. Most people don't put nearly enough in those areas probably because they feel large caps - big name companies we all know - are safer. Of course, "safer" often equals lower risk and lower return.

Also, for all the people who think they don't need any bonds in their portfolio if they are younger, US Fixed Income took the #1 or #2 spot in 7 out of 20 years. This is why everyone should probably have some stake in bonds, even if you're in your 20s or 30s. In the past 20 years, that part of your allocation would have come out at or near the top about 1/3 of the time, helping to balance out down years in the equity market.

The only sure way to make money with a bond is to hold it to maturity.

Comment

-

Comment