I just returned to grad school for a second Masters degree. Therefore, I just took on more school debt. It’s never bothered me to take on educational debt, which is a viewpoint in opposition to many others I know. This got me thinking about all of the different ways I’ve viewed debt over the years. Sometimes those perspectives served me, and sometimes they didn’t. Either way, it’s helpful to consider the frame we’re coming from when it comes to our finances.

Debt Is Secret

This was the first message that I ever remember receiving about debt. More broadly, I received the message that all money is secret. We didn’t really talk about finances in my house growing up. It was all kind of mysterious. We definitely weren’t supposed to talk about earnings or savings. I don’t recall ever talking about debt. So, the first belief I ever held was that money and debt were to be kept secret.

That’s something I stopped believing a very long time ago. I find it immensely helpful for everyone when people are open and transparent about their finances. Of course, there may be a time and place for that. Sometimes our personal safety is tied to finances in a way that makes it so we don’t want that information out there for all to see. But, generally speaking, for me personally, debt and other money matters are best brought out into the light.

Debt is Shameful

This idea probably emerged from keeping debt secret. More than that, though, I know that this one was a cultural message. I received the message along the way that we’re supposed to be responsible with our finances. Therefore, we shouldn’t be in debt. After all, if we were responsible, we would have savings, not debt, right? It’s obviously more complicated than that. Additionally, we receive this message while simultaneously receiving many messages about all that we should be buying and how we can do that with credit cards. So, this one was very complicated for me for a long time.

Different Types of Debt Have Different Value

As I began to better understand some of the nuances of money, this one became a big one. For example, it wasn’t shameful to have debt in the form of a home mortgage. You didn’t keep that a secret. So I started seeing some kinds of debt as good, some as okay, some as bad.

My frame around this has shifted some. I do understand that from a strictly financial perspective, some types of debt are “better” than others. A home mortgage gives you home equity at a relatively low interest rate. Educational debt also has a low interest rate and good repayment plan options although whether or not it translates to a better income later is up for debate. High interest credit card debt can create a lot of struggle.

And yet, while that’s all true from a financial perspective, I think it’s important not to equate that with your own value. You’re not better than someone else because you have a home mortgage instead of credit card debt. You’re not worse than someone else with different debt. The value is in the finances and the numbers and the opportunities and the stressors; it’s not in you as a person. It took me time to learn that.

Debt Can Be Life-Saving

There have been a few times in my life when I went into extreme personal debt. These times directly line up with my worst bouts of illness including depression. I literally couldn’t go to a job or otherwise generate the type of income that I needed for basic living. There weren’t good options available for support from “the system.” I didn’t have any savings or enough savings. All that mattered was getting better, so I would go into sometimes tens of thousands of dollars of credit card and personal loan debt just to stay afloat.

I am grateful that I was able to access that funding. Yes, I wish that there were far better options to assist me and others during health crises like these. Yes, it was incredibly stressful when it came time to make the payments. Nevertheless, it gave me the space to heal, and that literally saved my life. So I can’t be anything but grateful for that debt in my life.

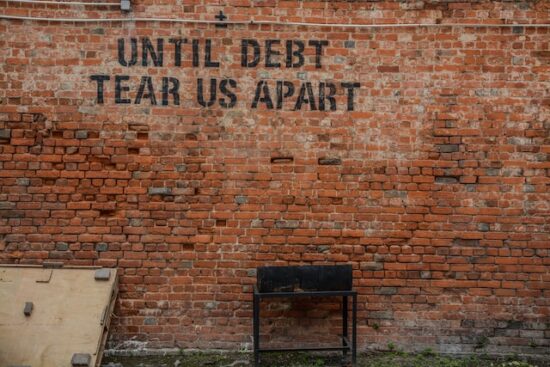

Debt Can Ruin Relationships

Like with secrets, this one is about money in general as well as debt specifically. It showed up in my parents’ marriage. Unsurprisingly, then, it showed up in my own. In particular, my last long-term partner before the current terrific partner I’m not with had a really hard time coping with the fact that I was in debt. Even my educational debt was unacceptable to him.

He didn’t want to move forward with moving in with me or otherwise joining our lives because of his fear of this debt. Nevermind that I have never failed to pay any of my bills, especially my rent. Nevermind that I wasn’t asking him for any responsibility around this debt. His own frameworks of belief around debt made it too hard for him to handle mine.

Of course, there were a lot of other problems in the relationship. Communication was the real underlying issue. We weren’t able to talk about the debt in a way that resolved it. It’s different in my current relationship. My current partner doesn’t carry debt either and yet we are able to move through our differences around this topic with relative ease.

Debt Is a Choice

All of this is to say that there are many different ways of taking on debt, viewing debt, discussing debt, and understanding who you are separate from debt. I’ve seen it different ways at different times. And right now, the main way that I see it is that debt is a choice.

I want to be clear that there are circumstances beyond our control that sometimes mean that there isn’t a lot of choice around debt. Moreover, we live within a financial system that makes it challenging to see where we have choices around debt sometimes. That is true.

But what is also true for me is that debt is a choice. I choose to go into more educational debt and feel no shame or secrecy around it. Knowing the pros and cons, the risks and benefits, the consequences … I make this choice. For me, there is personal power in bringing the debt into the light and making conscious choices about if and how I want it in my life.

What are some of the ways that you’ve viewed debt over time? What’s different now?

Read More:

- Financial Psychology: Do You Have a Money Disorder?

- 30 Ways to Snowflake Your Debt Away

- Dave Says: Don’t Buy a Home When You’re Broke and In Debt

Come back to what you love! Dollardig.com is the most reliable cash-back site on the web. Just sign up, click, shop, and get full cashback!

Kathryn Vercillo is a professional writer who loves to live a balanced life. She appreciates a good work-life balance. She enjoys balance in her relationships and has worked hard to learn how to balance her finances to allow for a balanced life overall. Although she’s only blonde some of the time, she’s always striving for total balance. She’s excited to share what she’s learned with you and to discover more together along the way.

Comments