Most Americans are living in financially tenuous situations. In fact, according to a recent study, nearly two-thirds of americans have under $1,000 saved and about a third have no savings at all. If you’re in this situation and want to get more cash banked, here is a five-part cash back savings strategy.

There are five elements: using cash back sites, using cash back credit cards, scanning your receipts, using coupons, and asking for discounts. All of them are easy and require very little time.

Use Cash Back Sites

The first part of the cash-back savings strategy is by using cash back sites. These sites are old but tried and true method that can give you 1 to 17 percent back. They work by shopping through the cash back site, clicking on the retailer’s site, and buying something through the retailer. The retailer will pay the cash back site for the traffic they’ve sent, and the cash back site will give you a cut.

The better ones are:

Rakuten.com ($10 sign up bonus)

befrugal.com ($10 sign up bonus)

You’ll need accounts at all of these. Rakuten and Swagbucks are the best known, but don’t always have the best deals. Dollardig has better offers than Rakuten, and Swagbucks on some items, but not on everything. Same with befrugal.com.

Use A Cash Back Credit Card

The second part of the cash back savings strategy is by using a cash back credit card. If you have a card that gives you cash back, use it when you buy through the cash back sites. This should give you another 1.0 to 1.5 percent off.

Be sure you get the card paid off every month. Credit cards can charge you 20 percent or higher — depending on how they’re calculated. They’re a form of legalized usury which is a plague on America’s finances. That said, if you can keep the balance paid off, cash back cards are basically free money.

If you want a cash back credit card, kill two birds with one stone and sign up for Credit Karma, it’ll give you a free credit score and match you with card offers.

Scan Your Receipts

Nobody really utilizes this option as much as they should. However, scanning receipts is a great way to realize additional savings.

Go with these smartphone apps. I’ve sorted them in order of hassles and payout from best to worst.

1. Pogo

2. Receipt Pal

3. Bitmo

4. Fetch

5. Coinout

5. ReceiptJar

6. ReceiptHog

7. Ibotta

Scanning your receipt with these seven apps could take up to .5% off the bill. Since you’re basically trading your shopping data for money, these apps are all slow payers. So you’ll want to work as many of these as you can. A lot of people wonder if they can use more than one, but it looks like they’re all separate organizations, so you can use all of them without getting banned or dinged.

Pretty much all these applications work on the same model. You’re basically providing shopping data in return for compensation. They all require a bit of setup. You’ll need to create accounts, add your email and Paypal information, etc. Usually, most of them want you to provide ready access to your credit card spending as well as any store accounts you have. I have all of these on my smartphone and regularly use them whenever I buy something.

Also, to avoid digital clutter, create a folder in your phone and add all of them inside. After shopping and scanning your receipts, they’re all in one place.

You won’t make a whole lot. The ones on my phone generate about $5 each every couple of months. However, every little bit counts.

Use Coupons

Item four in this cash back savings strategy is by using coupons. There are literally coupons for everything. Toys, cars, shoes, anything. You just have to find and use them. The only thing is, they’re not always called coupons. For some things such as houses, they’re called buyers refunds. And with cars, they’re called cash back deals. It’s all basically the same arrangement. It’s a deal that reduces the price you’ll pay for an item.

How Do You Find Coupons?

Sign up for store loyalty programs or reward programs. Also, if you know you want to buy a particular item, message the manufacturer and ask for a promo code or a paper coupon.

Another good way to find coupons is by checking the weekly circulars that come to your house. You can also get enrolled in your favorite store’s coupon program. Lastly, coupons.com and the like also have helpful apps.

Companies want you to use their coupons, you just have to ask for them.

A lot of people think coupons are too much trouble. However, this viewpoint overlooks the value of having even paper coupons in your home. For example, if you forget your paper coupons when you shop, you can always talk with the store’s customer service department and have the coupons applied to your account retroactively. I’ve been able to get $10 off grocery bills this way. You just need your receipt and the coupon.

Haggle and Ask For Discounts

Americans don’t like to haggle, but it matters. Asking for discounts greatly increases the likelihood of getting them. So don’t let your middle-class sensibilities get in the way of managing your finances well. For example, I was buying some holiday presents for my kids and got a 20 percent off at the toy store by asking if they had any discounts available.

The forum component of savingadvice.com has several good threads on haggling.

Here are some examples:

How To Haggle Like Your Old Man

Ask for discounts if you’re buying something damaged.

Put The Cash Back Savings Strategy Together With Investing

So, let’s put this cash back savings strategy altogether. Use all five of these methods in combination consistently.

None of these specific methods will make you an overnight millionaire. But if you get in the habit when you’re shopping you’ll likely see good long-term results. Even if you’re consistently shaving 1 or 2 percent off your bills, the difference will start to add up over time. And, you’ll see even better results if you invest the savings.

Competition in the brokerage industry has virtually eliminated the barriers to investing. A lot of newer companies such as SoFi, Robinhood, or any of the new bond companies will let you move transactions for a dollar or less seamlessly. So, there really aren’t any barriers to investing small amounts of money. Every dollar you save can bring you substantially more over the long run.

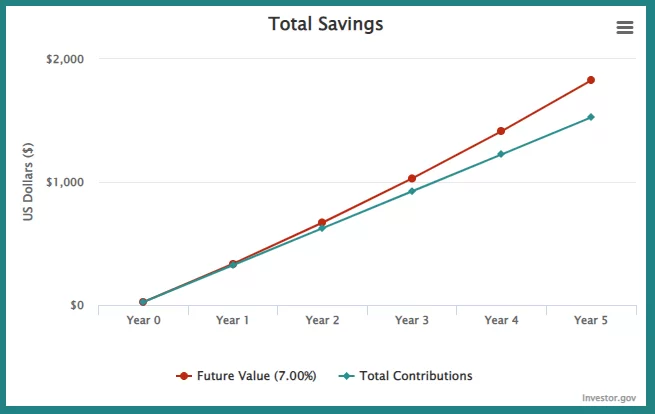

By way of a conclusion here, if you’re savvy about investing your savings, even a small amount of money saved consistently can add up very quickly. Let’s say you work these methods and come up with $25 every month from using them. Let’s also assume you get 7 percent interest per year and it’s compounded semi-annually.

Here is a handy chart showing what your situation would look like in five years.

After saving for five years, you’d have about $1,794.87. That is enough for a car down payment, a nice emergency fund, a vacation, or college tuition payment.

And if you think you can’t get 7 percent per year consistently, the reality is you can. And you can do it today. Inflation-linked bonds from the Treasury are currently paying 7.12 percent. Small business bonds are currently paying between 6 and 8 percent.

This strategy is comprised of simple and easy methods. All you have to do is make it happen.

For More Great SavingAdvice articles, read these:

Take The Original 52 Week Money Challenge and Save $1,300

Super Easy Fryer Savings Tips To Reduce Your Laundry Costs

Best Cashback Monitors On The Market

Check out the Money Savings Tips From The SavingAdvice tools Section.

James Hendrickson is an internet entrepreneur, blogging junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.

Comments