Two things in life are certain: death and taxes. However, the American tax code can make it very difficult to determine exactly how much you owe the federal government. It becomes even more complicated when the IRS sets varying rates on different kinds of income and fluctuating taxation brackets. However, arming yourself with information can save you a ton in taxes. That is why every investor should understand how long-term and short-term capital gains will affect their tax return.

What’s the Difference Between Long and Short-Term Gains?

Capital gains are the profits earned from selling your assets. They occur when you sell your asset for more money than you originally paid. Assets come in many forms. Some of the most common types include stocks, bonds, real estate, businesses, vehicles, jewelry, and precious metals. But, people often forget one very important detail. When you sell an asset, you must pay the capital gains tax based on the length of time you held it.

The federal government categorizes capital gains as either long-term or short-term. This designation determines the amount of taxes paid on an asset. Long-term capital gains are generated from assets that you have held longer than one year. Conversely, short-term gains are from assets that you had less than a year.

Taxation of Long and Short-Term Capital Gains

There is no way around the capital gains tax: you will have to pay taxes any time you sell off assets. However, the rate you pay depends on the holding time. For clarification purposes, the holding period begins the moment you acquire the asset. It lasts until, and includes, the day you sell it.

File Your Taxes with H&R Block

Taxation of Long-Term Gains

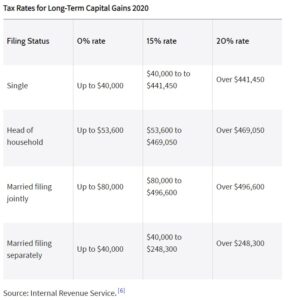

Since the Tax Cuts and Jobs Act (TCJA) in 2018, the treatment and taxation of long-term gains have changed. Prior to this, the brackets closely reflected the income brackets. However, the brackets were reconfigured under this new piece of legislation.

In general, the rates on long-term gains are more favorable. The government taxes a percentage of your long-term gains according to graduated thresholds of taxable income. These thresholds change from year to year. However, most taxpayers pay a rate of 15% or lower.

Taxation of Short-Term Gains

Unfortunately, short-term capital gains are taxed like ordinary income, meaning you will usually pay more. Your income includes your salary, wages, and gains from any investments you hold. The percentage is determined according to your tax bracket. The U.S. has seven federal tax brackets based on income, with rates ranging from 10% to 37%. One thing people often fail to consider is the added gains will increase your overall income. Not only could it push you into a higher tax bracket, but also increase the taxation rate. Depending on which tax bracket you fall into, the gains tax could be a significant amount of money.

Capital Gains Tax Considerations

In addition to how long you have held an asset, there are a few other tax implications and considerations when it comes to long and short-term gains.

State Taxation of Capital Gains

Each state has different tax laws as well. So, whether or not you pay state taxes on capital gains depends on where you live. Some states do not have income taxes. Therefore, they do not calculate capital gains taxes in Alaska, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington, or Wyoming. If you are a resident of Colorado, Nevada, or New Mexico, you do not pay any capital gains taxes either. Taxpayers in Montana also enjoy a credit to help reduce the final totals owed to the IRS.

Capital Gains for Retirement Accounts

Eventually, you will also need to pay taxes on your retirement accounts too. However, you can defer tax payments on IRAs and retirement accounts until you withdraw money from them. When it comes time to pay though, the federal government will still tax it as ordinary income. Even if profits were generated from long-term gains, you do not qualify for the lower rates.

Exceptions from the Capital Gains Tax

As with all rules, there will always be exceptions to them. Here are a few you should be familiar with.

- All collectibles are taxed at 28%. This includes any antiques, art, jewelry, coins, precious metals, or valuable collections. This is especially important when dealing with questions of inheritance and transferring items from estates.

- If you sell your principal residence, you can exclude $250,000 of your capital gains from your taxable income. However, there is some fine print you will want to read twice. You must have owned and lived in the property for at least two years in the five years prior to the sale. But, if you qualify for the exemption, it could save you a ton of money in taxes.

- The Net Investment Income Tax (NIIT) tacks an additional 3.8% of capital gains taxes if your income or investments exceed a certain maximum. This is usually applied to high earners who also have large capital gains on income generated from interest, dividends, and other investments.

When Taxes Come Due…

At the end of the day, the tax collector comes round to collect his dues. However, if you are well-informed, it could help you avoid paying more than you need to. First, you must remember that your net gains are calculated on a sliding scale. The price you paid, less depreciation, and costs incurred from the sale or improvement of the asset could decrease the total due. These factors all contribute to the final tally of your capital gains taxes.

It is also important to note here that you are also able to minimize capital gains taxes with time. As stated above, long-term gains receive much better rates. If you hold the asset until it can be qualified as long-term, you will likely pay less in taxes. So, if you are thinking about selling your newer assets, you may want to consider holding on to them until you can apply the lower rate.

Read More

- Capital Gains Exemptions on Principal Residence

- Long-Term Investing: Benefits and Best Ways to Start

- A Beginner’s Guide to Understanding Mutual Funds

If you enjoy reading our blog posts and would like to try your hand at blogging, we have good news for you; you can do exactly that on Saving Advice. Just click here to get started.

Check out these helpful tools to help you save more. For investing advice, visit The Motley Fool.

Jenny Smedra is an avid world traveler, ESL teacher, former archaeologist, and freelance writer. Choosing a life abroad had strengthened her commitment to finding ways to bring people together across language and cultural barriers. While most of her time is dedicated to either working with children, she also enjoys good friends, good food, and new adventures.

Comments