If you’re like most people, you have a lot of tax questions. Sure, you know how to do the basic things when it comes to your taxes. But, you want to maximize your refund without making any mistakes. Therefore, a lot of questions come up. With tax time fast approaching, we wanted to make sure you have the answers to your top 10 tax questions.

Tax Questions and Answers

It makes sense to have questions when it comes to filing, especially if you’re wondering things like why your refund is smaller. Here are some of the most common tax questions and answers.

1. Do I Have To File Taxes?

If you earned money in the United States in 2018 then chances are that you have to file taxes. However, there are some exceptions. They depend upon several factors including:

- Age

- Dependency status

- Filing status

- Gross income

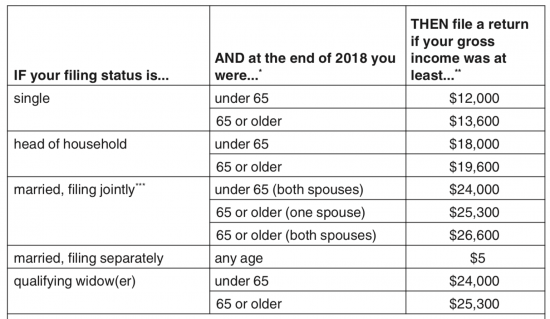

If you are 65 or older, then it affects the income requirement for filing. For example, if your filing status is “single” and you are under 65 then you must file taxes if your gross income was $12,000 or more. However, if you are over 65, then you can make up to $13,600 before you are required to file.

The above chart is from IRS Publication 501. It shows you the basics of whether or not you need to file 2018 taxes. However, there are exceptions. For example, if you received $400 or more from self-employment or any amount at all from a Health Savings Account, then you need to file. Therefore, if you are considering not filing, you should review this publication in its entirety to make sure that’s okay. After all, if you are supposed to file but don’t then you might get charged penalty fees.

2. Should I Claim a Dependent on Taxes?

One of the biggest recent tax changes was the elimination of personal exemptions for dependents. In other words, you used to get a certain amount of deduction per child or another dependent. However, that’s no longer the case. Nevertheless, if you have dependents, then you might still benefit from claiming them.

For example, although you no longer get a deduction for children who are dependents, you can still get the Child Tax Credit. In fact, more people qualify for this credit than before. Here are the details:

- You have at least one child who was age 16 or younger in 2018.

- The child has a valid SSN.

- You earned at least $2500 in income in 2018.

- As a single taxpayer, you earned $200,000 or less.

- As a joint filing married taxpayer, you earned $400,000 or less.

You can get $2000 per child from this credit.

3. Do I Qualify for the Earned Income Tax Credit?

If you are a low-income or mid-income earner then you likely qualify for the Earned Income Tax Credit. As long as you earned at least $1 in income, then you might qualify. You must either be single or married filing jointly to receive this credit. You cannot have received investment income exceeding $3500. Furthermore, you can’t have received foreign income. With that in mind, you may qualify for the EITC if you meet the following criteria:

- You have 0 children and earned less than $15,270 (single) or $20,950 (married, filing jointly)

- You have 1 child and earned less than $40,320 (single) or $46,010 (married, filing jointly)

- You have 2 children and earned less than $45,802 (single) or $51,492 (married, filing jointly)

- You have 3+ children and earned less than $49,194 (single) or $54,884 (married, filing jointly)

4. I’m In School. Can I Claim an Education Credit?

There are two education credits available: the American Opportunity Credit and the Lifetime Learning Credit. Furthermore, there is the Tuition and Fees Deduction. (Deductions reduce your amount of taxed income whereas credits give you direct money back.)

Each of these credits has its own requirements. For example, you need to be at least a half-time student in the first four years of college to qualify for the American Opportunity Credit. In contrast, the Lifetime Learning Credit is available to students at any stage of higher education who took at least one course in 2018.

Therefore, if you’re a student, and you haven’t maxed out your credits, yet, then you might qualify for a credit or deduction. Review IRS form 8863 and Publication 970 for more details.

5. Should I Take the Standard Tax Deduction?

You have the choice to take a standard tax deduction or to itemize your taxes. If you’re filing as single or married (filing separately) then the standard deduction for 2018 is $12,000. It’s twice that if you’re married, filing jointly. It’s $18,000 if you’re filing as head of household. Therefore, if your itemized amount is less than that, then you’ll want to take the standard deduction.

Of course, the only way to determine that is to itemize and see the numbers. Tax software generally makes that process fairly quick and easy. However, if you’re not using tax software, and you want a quick guesstimate about whether or not to take the standard deduction, then one way is to check your mortgage interest deduction. Look at Form 1098, which is the Mortgage Interest Statement you should have received. If that amount is close to or higher than the standard tax deduction, then you should itemize for the biggest refund.

6. I Used to File 1040 EZ or 1040 A. What Should I Do This Year?

There used to be three forms of the 1040 tax form, including the two mentioned. However, the rules have changed. Now you will just use form 1040. It’s the same form for everyone. It’s been redesigned to streamline the process.

7. Do I Need to File Any Schedules with My 1040?

As mentioned above, everyone will file their taxes using Form 1040. However, if you meet certain circumstances, then you may need to file one or more of the following schedules in addition to that form.

Schedule 1

You may need to use this schedule if you have income in addition to your regular wages. For example, if you received alimony, rental income, or gambling winnings over a certain amount then you may need to use this form.

Likewise, you may need to use this form if you made certain payments that affected your income. If you paid alimony, student loan interest, or deductible moving expenses then you use this form.

Schedule 2

You need to file this if you owe the alternative minimum tax or the excess advance premium tax credit repayment

Schedule 3

You may be able to get certain credits using this form. They include the foreign tax credit, education credit, and home energy credits.

Schedule 4

You may owe additional taxes in certain instances, in which case you will add this schedule. For example, you’ll use it if you owe a self-employment tax or a retirement plan tax.

Schedule 5

You need to file this if you plan to claim a refundable tax credit except for certain ones including the earned income tax credit. You also need to file this if you are making a tax payment related to getting a tax extension.

Schedule 6

If you have a foreign address then you need to use this schedule. You also need to use it if you want to allow a third party to discuss your taxes with the IRS.

The above situations are some, but not all, of the reasons to use each of those schedules. Review your taxes in depth to determine if you require any of these.

8. Are Social Security Benefits or Pension Taxable?

Social Security benefits are taxable. It’s calculated based on your combined income which is your adjusted gross income plus half of your social security benefits plus any nontaxable interest. If that number is at least $25,000 (single) / $32,000 (married, filing jointly), then you owe taxes on your Social Security benefits. The exact amount varies depending on your income.

If you have a pension, then it is likely to be taxable, too. There are some exceptions. For example, certain military pensions are partially or entirely non-taxable. If you received a 1099 for your pension then it will tell you the exact amount that is taxable for 2018. Check that for your personal information.

If you made a withdrawal from your retirement plan, then that is probably taxable. For example, if you took money out of a 401(k) or an IRA in 2018 then you’re probably going to owe taxes on it. However, you only owe for the withdrawal. If you earned interest on those same accounts but did not make a withdrawal then you do not owe taxes on it at this time.

9. When Will I Get My Tax Refund?

It typically takes 1-2 weeks for you to receive your tax refund. If you get direct deposit, which is the quickest option, then it should arrive in your account in approximately that amount of time after you file. If you request a check instead, then it should be mailed by then, and it will take another 3-7 days before it arrives in your mailbox.

However, the closer you file to the April 15th deadline, the more likely it is that you’ll experience a delay. Moreover, if you have applied for either the Earned Income Tax Credit or the Child Tax Credit, then your refund may take a little longer. The IRS apparently reviews those two things more carefully than other tax form details.

10. How Can I Get More Tax Answers?

One of the best places to ask your tax questions is through the Interactive Tax Assistant Search on the IRS.gov website. You aren’t connected to a live person, so you won’t get answers to detailed, rare-scenario questions. However, you can find answers to all of the most common tax questions through this tool. You’ll be able to enter your own specific information to get an answer that is right for you, rather than just a confusing general answer.

What are your biggest tax questions?

Read More:

- How Do You Get a Hold of a Live Person at IRS?

- Get the Facts: Common Tax Myths

- What Happens if You Don’t File Your Tax Return?

Kathryn Vercillo is a professional writer who loves to live a balanced life. She appreciates a good work-life balance. She enjoys balance in her relationships and has worked hard to learn how to balance her finances to allow for a balanced life overall. Although she’s only blonde some of the time, she’s always striving for total balance. She’s excited to share what she’s learned with you and to discover more together along the way.

Comments