What Does a Bullet Journal Budget Look Like?

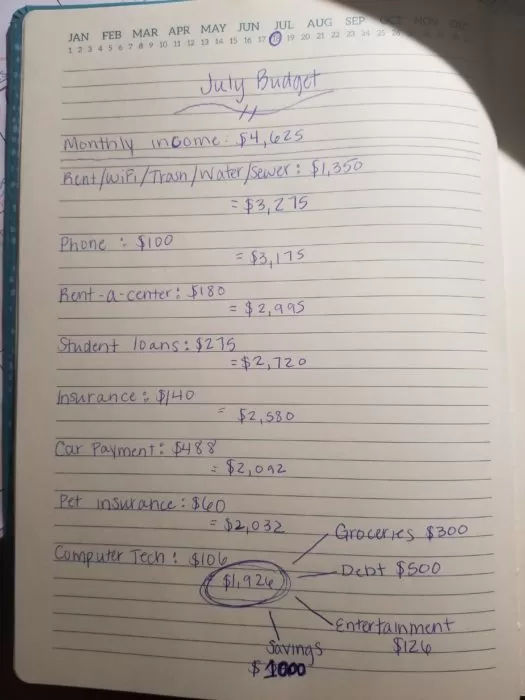

Bullet journals aren’t exactly a new concept but, for some people, it can be a great way to stay on top of your finances. In general, a bullet journal budget would look something like this.

On top of writing out your monthly budget, you can track a number of other aspects of your everyday finances as well.

Write Down Financial Goals

What are your financial goals? Write them down in your bullet journal. You can decorate this page and keep it towards the front of your journal to remind you why you are budgeting, saving, and tracking.

Track Your Spending

If you are trying to get control of your spending, you may want to journal your spending habits for a week. Some people find writing down every single time they spend money helps them spend less. It is also a good way to examine your spending and discover places you can trim in your budget to save.

Create Pros and Cons Lists

A great use of a bullet journal is creating pros and cons lists. For instance, if you are considering spending a large amount of money on something or pulling out a loan, you can create a list of pros and cons. Once you have everything out in front of you, you can make an educated decision about what is best for your finances.

Keep Tabs on Your Saving

Tracking progress in your bullet journal is also important. It can be a great way to motivate you to continue saving money when you want to spend it on something you don’t necessarily need. Decide on an interval for when you’ll track your progress and then write it down regularly. For tracking savings, you can write down the total amount in your savings account down once a week or once a month. Seeing that number increase each time you write it down can be encouraging.

See Progress in Paying Off Debt

You can also use a bullet journal to track progress in paying off debt. Similar to saving money, you will write your total amount of debt at the top of the sheet of paper and subtract the amount each time you make a payment. As you see your debt dwindling, you’ll find yourself motivated to pay it off even more quickly.

Other Great Things to Track in a Bullet Journal

- Meal planning: Planning out your meals for the week or tracking your daily diet in a bullet journal is a great way to stay on top of your nutrients. Jot down any recipes you need and be sure to incorporate easy meals to keep yourself from eating out. It is also a good idea to tally your water intake as well.

- Fitness/workouts: Tracking your workout in a bullet journal is a good way to see progress. For instance, if you are working on bettering your mile time, you can log the time it takes you to run a mile every day. Seeing the progress will motivate you to keep going.

- Life goals: The front of your bullet journal is a great place for big goals. If your bullet journal focuses mainly on finance, be sure your financial goals are listed towards the front. Journals with fitness logs may have long-term weight or health goals listed at the beginning.

- Travel experiences: Lastly, bullet journals are great for jotting down experiences while you are traveling. It is a great thing to look back on and remember your time on vacation or visiting another destination.

All in all, you can truly thrive using a bullet journal to track your finances as well as other aspects of your life. So, what are you waiting for? Will you try a bullet journal budget or any of the ideas mentioned above?

Do you need help figuring out your budget? Join us in the Saving Advice forums for discussion on real people and real finances.

What type of budgeting system do you use? Tell us about it in the comments below.

Read More

- The Importance of a Financial Journal

- Journaling For A Frugal, More Productive Life

- The Difference Between Budget Living and Being Cheap

- Grocery Budget: When You Shop Can Save You Money

Comments