Don’t overlook your retirement plan as a source of short-term liquidity. You can borrow against 403(b), 457(b), 401(k) or a Roth IRA if the plan sponsor allows it, but only the solo 401(k) lets you do so without having to pay penalties or interest.

Don’t overlook your retirement plan as a source of short-term liquidity. You can borrow against 403(b), 457(b), 401(k) or a Roth IRA if the plan sponsor allows it, but only the solo 401(k) lets you do so without having to pay penalties or interest.

Among the plans that offer loans, the IRS limits borrowing against them to “(1) the greater of $10,t000 or 50% of your vested account balance, or (2) $50,000, whichever is less.”

You can take out more than one loan at a time but the total amount of outstanding borrowed funds must not exceed the maximum stipulated by the IRS.

Borrow Against 403(b) or Other Retirement Plans

Interestingly, the interest charged on loans against 403(b), 457(b), 401(k) and Roth IRA plans are set by the retirement plan sponsor. But if you decide to just cash out altogether by withdrawing funds early, rather than borrowing, you pay a 10% penalty if you’re below age 59.5.

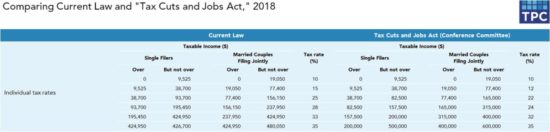

That 10% does not include taxes, and unfortunately these withdrawals are taxed as income, according to the bracket you fall into.

A retirement plan withdrawal has the potential to move you into a higher tax bracket for the year — and the boundaries between each of the brackets has moved under the newly enacted Tax and Jobs Act, as you can see in the table below.

Go Solo If You Can

As alluded to earlier, borrowing from a solo 401(k) is cheaper than other types of loans in the most literal sense that there’s no interest nor penalty.

However, the longer you take to repay the loan, the more of an opportunity cost you incur because your money is not getting the chance to accrue value through being invested in the market.

If your credit score is less than perfect, you might find borrowing from your retirement plan to be a great deal cheaper than any other type of loan.

What If You Have No Other Choice?

Although lenders have eased up their guidelines for approving loans in recent years, it’s entirely possible you still might not qualify for any loan at all if your credit score is below 600.

This might leave you no other choice but to borrowing against 403(b) or any other types of retirement plan you might have.

But if you have no other way to borrow money, rethink whether taking on any additional debt will help your situation — it may not help.

You may gain some clarity about this decision by obtaining the total cost of borrowing from your retirement plan — this calculator helps you arrive at that.

Readers, have you thought about whether to borrow against a 403(b) or other type of retirement plan?

Jackie Cohen is an award winning financial journalist turned turned financial advisor obsessed with climate change risk, data and business. Jackie holds a B.A. Degree from Macalester College and an M.A. in English from Claremont Graduate University.

Comments