Let’s walk through an answer to that question.

First, we need to determine what a typical mortgage payment for a million dollar home looks like, then we can generate an estimate of the annual income you’d need to afford the mortgage. So, what does a mortgage usually cost you? Mortgage expenses typically involve the following:

- Principle and interest (P&I)

- Taxes

- PMI (Private Mortgage Insurance)

- Homeowner’s insurance

Principal And Interest

According to Bankrate.com, the average interest rate on a 30 year mortgage is 4.08 percent. Using a mortgage calculator, the monthly principal and interest payment on $1,000,000 would be $4,820.00.

Property Taxes

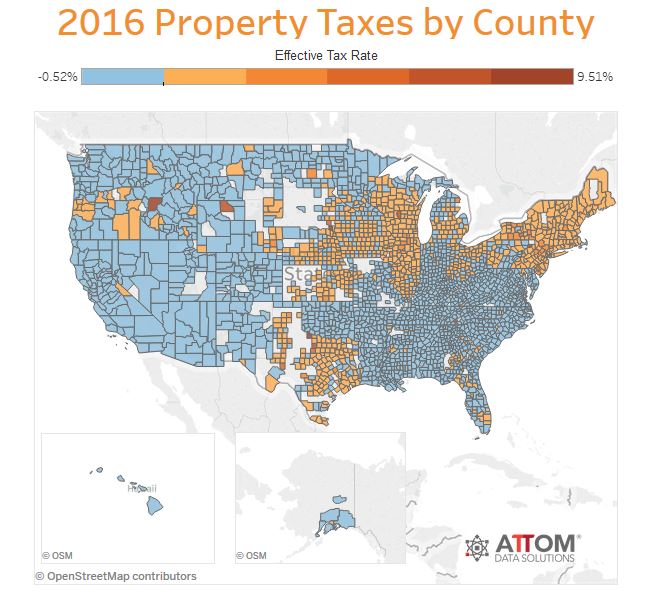

Although property tax rates differ significantly depending on the county where you live, data provider RealtyTrac.com lists the average 2016 property tax rate in the US as 1.21%. Here is a fun graphic which shows some of the differences between counties.

Source: Attomdata.com.

Using the average property tax rate of 1.21%, a home assesed at $1,000,000 would have an annual property tax bill of $12,100 or $1,008.33 a month.

Private Mortgage Insurance (PMI)

Private mortgage insurance (PMI) is typically required until the loan to value ratio on a mortgage drops below 80%. PMI terms also vary, but for most mortgages PMI is paid monthly. According to the Federal Housing Administration (1), on average a million dollar mortgage will have a PMI cost equal to 1.05% of the loan, or $10,500. This gives you a monthly PMI payment of $875.00.

Homeowner’s Insurance

The cost of homeowner’s insurance will vary based on location, deductible, coverage and other factors. Nationwide the average homeowner’s policy costs $964 a year (1), or $80.33 per month.

Total Payment

Using the numbers above, our sample mortgage payment for 100% financing on a million dollar home is:

Principal and Interest: $4,820.00

Property Taxes: $1,008.33

Private Mortgage Insurance: $875.00

Homeowner’s Insurance: $80.33

Total Monthly Mortgage Payment: $6,783.66

Income Needed To Afford a Million Dollar Home

With this ballpark estimate of how much a million dollar mortgage payment is, we can determine what kind of income is required to afford it.

Since the personal finance rules of thumb say a mortgage payment should be no more than 28% of your monthly income, you’d need about $290,728.20 annually to carry the mortgage on a million dollar home.

There is a lot of variability in determining what a mortgage payment would be for a home worth a million dollars. The figures in this article are sample values. How much the actual amount is will depend on your credit, how large a downpayment you have, prevailing rates of interest and the market for insurance in your state. However, given the template of how the value is calculated you should be able to gather the information required and answer the question, “How much income do you need to afford a million dollar home?”

For more of our great articles, consider reading:

- Save Over $1,300 With The 52 Week Savings Challenge

- How Much Would You Have to Make to Buy a 250,000 House?

- Is Putting A 20% Downpayment On A House Realistic?

Alexa Mason is the blogger behind Single Moms Income, a personal finance freelance writer, and an online entrepreneur. Come hang out with her on Facebook and Pinterest.

Comments