What is the Cashflow Quadrant?

The Cashflow Quadrant was developed by financial guru and author Robert Kiyosaki. This guide teaches people how to be financially free; it shows people how to work less, earn more, and pay less in taxes. Originally published in 1998, “The Cashflow Quadrant” was written by Kiyosaki and is the second in his “Rich Dad, Poor Dad” series. But, how, exactly, does it work?

How does it work?

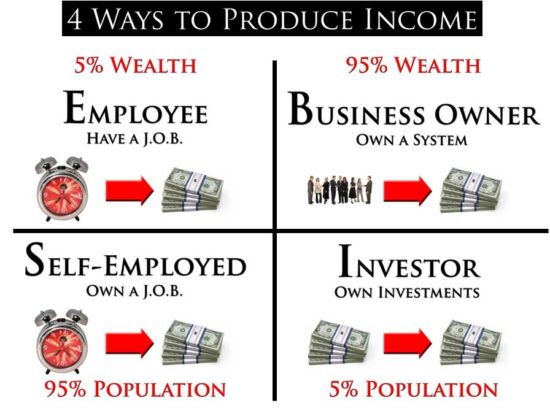

As stated in a YouTube video titled, “Robert Kiyosaki explains the Cashflow Quadrant,” (see below) Kiyosaki’s dad showed him a diagram as a young boy. His father called this diagram the Cashflow Quadrant and explained to him that it was made up of four different people in the business world. They are:

- E

- S

- B

- I

In this graph, which is divided by two lines making a cross or lowercase “t” shape, E’s are employees. He explains that employees can be differentiated by their core values.

“Whether the president or the janitor of the company, they will always say the same words. The words are, ‘I’m looking for a safe, secure job with benefits.’ That’s what makes them an employee because their core values are security,” he said.

Below them are the S’s. The S represents self-employed or small business owners. Their core values, according to Kiyosaki, are to do it yourself if you want it done right. The S also stands for solo, meaning they act by themselves.

Then, to the right f the quadrant, sit the B’s, also known as the businesses. Kiyosaki mentions that Forbes describes big businesses as those with 500 or more employees. The core values of the individuals in this category include looking for talented people to run their business for them and building a great network for continued growth.

Finally, the unassuming I’s make an appearance. This part of the quadrant is where the big key factor comes in: financial freedom. The I’s are investors, and they make money work for them.

“Early on in my life, it was my poor dad who was always saying to me, ‘Robert, go to school so you can get a high paying job,’ so my poor dad’s core value was to be an employee,” Kiyosaki said. “He wanted job security, promotions, a steady paycheck and all this.”

His rich dad, on the other hand, advised Robert to build businesses if he really wanted to be rich. And so, he encouraged Robert to become a business owner and business investor. His core values were to work hard to own something rather than work hard with the risk of losing your job or being fired.

This, the left side of the quadrant works for security and money. But the right side wants freedom. The key is to work hard for a few years and create a passive income so that money keeps flowing to you.

How to apply it

Kiyosaki recommends for those looking to make the switch from trading time for money for making money work for you, they should consider multi-level or network marketing. Even though he himself has never been a part of an MLM, he states that it is a great way for people to transfer from the left side of the Cashflow Quadrant to the right side for a small investment. These companies provide the tools and coaches already for you. Be careful, though; many can be a scam or are unethical.

Typically, the skills needed to be a B or an I are not taught in traditional school settings. Rather, they are learned more from experience and other experts in the field. If you’re interested, look for a mentor who is willing to help guide you along the way. Additionally, start attending seminars, take training courses (many are available online), and be willing to step outside of your level of comfort. It can be easy to lose sight on what it is you’re aiming for but staying focused will help.

You’ll also want to gain a strong support system. Whether you choose the MLM route to start off or going at it yourself, financial freedom is not easy to accomplish and does not just fall into your hands. It takes sacrifice and dedication, so having people there to cheer you on will be important.

Conclusion

Kiyosaki says to always remember it is not money that makes you rich, it is business skills. Ultimately, you have to decide if this is right for you. Changing from the left to the right side means changing your core values, which can take time and determination. The path to financial freedom still requires hard work, but it does involve building more connections and passive streams of income so that you work less over time.

It is also possible to still be a part of each quadrant in some way, but usually, one will define you the most.

Are you a believer in the Cashflow Quadrant? Do you follow this diagram yourself?

Comments