As we go about our daily lives, the weeks can really escape us. Personally, I cannot rely on my online banking services alone to track my spending and savings. I am definitely someone who prefers a paper trail. So, in recent years, I began to write things down more.

The Monthly Money Challenge

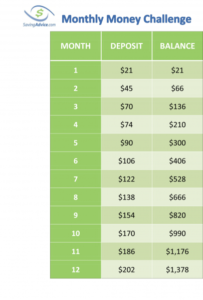

Two years ago, I decided to kick-start and dedicate regular amounts to my savings account by following the 52-week money challenge. This was great for keeping me on track each week and ended with $1,378 extra in my savings account. This year, I am going to try to monthly money challenge and challenge you to as well. I will be contributing in $25 increments. But, I will be doing it backwards since my starting month will be January and the end of the year seems to always be the most stressful financially with holiday shopping. So, my savings plan will look like the following:

- Month 1: $300

- Month 2: $275

- Month 3: $250

- Month 4: $225

- Month 5: $200

And so on until I am only putting in $25 for the month. By the end of 2017, I will have saved an additional $1,950.

One thing that puts this into perspective for me is that it breaks down to roughly only $5.34 a day. This is not so bad, right?

How much should I save?

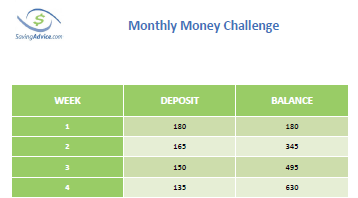

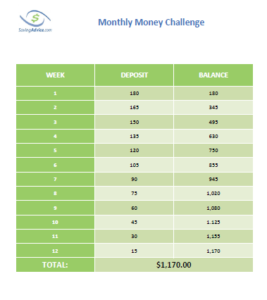

If this seems like a lot for you to save, you could always lower the amount and follow suit by starting with the highest deposit first. Here is what it will look like if you do $15 increments:

Of course, there are other ways you could do the monthly challenge as well. Some take the 52-week money challenge and turn it into a monthly deposit. So, your deposits would look something like this:

There is another common and interesting way to do this monthly money challenge, and that would be to start and end with $25 deposits. Here is what we mean:

- Month 1: $25

- Month 2: $50

- Month 3: $75

- Month 4: $100

- Month 5: $125

- Month 6: $150

- Month 7: $150

- Month 8: $125

- Month 9: $100

- Month 10: $75

- Month 11: $50

- Month 12: $25

- Total ending balance: $1,050

Although a little less in savings, it may be easier to handle if you are having a hard time with your budget. Considering in January you may still be financially recovering from the holidays and December you are shopping more than usual, committing to $25 in those two months seems feasible.

If you are interested in doing this challenge yourself, you can download a template here.

What to keep in mind

What makes money challenges great is the fact that they practically dare you to put money aside. This form of encouragement makes giving up the funds to savings much easier. However, they should also not be your only source to save. You should be working toward placing more money in to create a strong cushion. An ideal emergency savings plan will be able to cover your expenses for at least a couple months should a financial emergency take place, such as losing your job.

Have you ever done a money challenge before? Will you be trying this one?

Comments