A recent Saving Advice article called on all of us to pursue the path of kindness when confronted with people who are suffering as a result of our current economic crisis. I am very much in agreement with the author’s plea that we approach people in hardship without “anger” or “resentment” – those emotions are not going to help anyone – but I cannot agree that we should address people in financial distress without “judgment.”

We have to judge the mistakes of others and doing so is neither cruel nor hateful. It is merely a way of acknowledging that mistakes were made. Indeed, if we do not acknowledge the mistakes that are at the root of a problem, I do not believe that we can address the problem.

A colleague of mine who was laid off from his job at the same time that I was (about 15 months ago) mentioned in an e-mail that he has been able to weather the economic storm because he has been “saving, saving, saving” for the past several years. I have been doing the same and, although the depletion of our bank accounts is unsettling, I still have a cushion to see me through to a job later this year (I hope!).

While we were saving our money, and buying comparatively modest homes, our other colleagues were chiding us for not investing heavily in the stock market. They could not understand how we could be content owning only those things that we knew we could afford or how we could stay home and relax on our vacations, rather than travel the world. For that matter, I was often asked why I was driving such an old truck (a 2002 model with only 80,000 miles on it – so still young in my mind) when I could trade it in for a new vehicle.

When we look back on the past decade and more, we see a global culture that was engaged in hyper-spending based on theoretical money. Even after the dot com bubble burst, and people started to realize that the value of so many dot com success stories amounted to little more than vapor, people in the USA continued to believe that housing prices would continue to rise forever. As a result, homebuyers over spent for fear of being left out of the riches that could be gained from the appreciation of real property.

So where does that leave us now, when we have to deal with all of the millions who are suffering? Where does it leave us as individuals as we look at our own problems and our own mistakes?

It leaves us as judges.

And that is not a bad thing. For too long, Americans and people in other developed nations have lived with a sense of entitlement. A sense that success should come easy. A sense of “I’ve want what I’ve got coming to me.” The thing is, we have no entitlements. Success does not come easy. The only thing that is coming to us is what we earn. Someone needed to remind us of that a long time ago. We all should have had judges to tell us what we were doing wrong.

So I suggest, the next time you encounter someone with a problem, judge them. If they caused their own problem and they are not acknowledging it, tell them clearly, but without malice, that they screwed up. That is judgment.

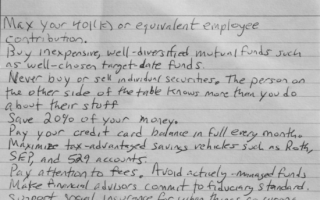

But do not stop there. After you have judged, you need to go on to inform. Explain how the problem could have been avoided and what the person can do to remedy it going forward. If the problem cannot be remedied, be clear about that and then encourage the person to move on.

The problems arising in our economy today are of our own manufacture. We are all judged to be at blame and there is no harm in admitting it. In fact, if we did more consistently assess ourselves and those around us, and pass judgment on the merits and flaws of our collective behavior, we may find that we do not create another economic crisis a generation after the current crisis ends.

What do you think? Are we tough enough to give tough advice and to receive it? Shouldn’t we be strong enough to be judged? We all have flaws and failings. Is it time that we accepted them and were able to hear other people admit them to us.

Comments