The Debt Payoff Planner mobile app tracks your debt and other financial details so that you can start reducing your debt. It tracks all of your payments, makes a list of your debts, and helps you create a customized strategy for paying off your debts. The app provides a plan for every month of the year and has an easy to understand summary table.

Goodbudget

The Goodbudget Budget Planner can help you create a budget, save for expenses, and establish financial goals. Charts help you visualize your spending. You can share your budgets with other people in your household through the cloud sync feature.

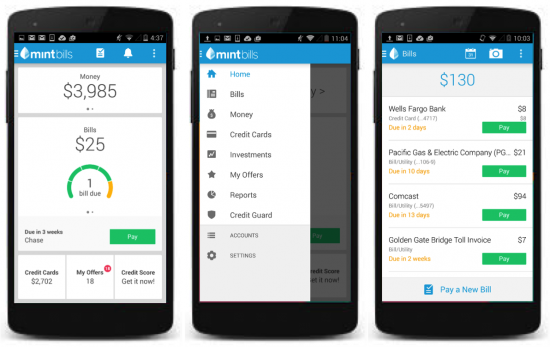

Mint

Mint is an easy to use personal finance app that offers a complete picture of your financial life. Once it is connected to your bank, credit card, and investment accounts, it tracks your spending, creates budgets, monitors your accounts, displays bill reminder alerts, and shows your cash flow in real time. Mint also provides customized suggestions on ways to reduce fees, cut spending, and save more money.

Money Flow

The Money Flow app gives you an overall view of your finances, income, and expenses so you can manage your finances from your mobile device. Using the app, you can also create custom expense categories, a variety of graphs, and a transaction history of income and expenses.

Mvelopes

Mvelopes links with your bank accounts to help you track your spending, maintain a budget, pay your bills, and track your receipts. The app gives you a real time view of all of your accounts and transactions and helps you identify hidden spending.

Personal Capital

The Personal Capital finance tracking app helps you track your spending and create budgets while providing a complete view of all assets, liabilities, and investment holdings. Personal Capital is ideal for investing and retirement planning.

Prism

The Prism app, available for the iPhone and Android, helps you track all of your bills with a detailed schedule of due dates and payment amounts. You can pay your bills directly through the app, eliminating delays and late fees.

Quicken

Quicken is one of the most comprehensive apps to track money. It is easy to use, set up, and link to all your financial accounts so you can track your spending habits, set a budget, get bill reminders, save receipts, and find your free credit score. The app offers convenient spending graphs and automatically syncs data from your computer to your phone or your tablet.

Spending Tracker

Spending Tracker records expenses and income, creates spending reports, and displays information using interactive bar graphs and pie charts. You can also establish a budget using the app and track your spending to ensure you are remaining under budget every month.

Alexa Mason is the blogger behind Single Moms Income, a personal finance freelance writer, and an online entrepreneur. Come hang out with her on Facebook and Pinterest.

Comments