Drop the Cable TV

No matter how much you think you need it, the chances are that you won’t miss it much once it is gone and there are many ways to reduce the amount of TV you watch. In fact, not only can it save you money, it can end up making you a lot of money if you use the extra time you spent in front of the TV doing more productive activities.

Drop the Gym Membership

If you really need to continue to exercise, there are plenty of ways to do it for free. Start walking more or start riding your bike more. There are plenty of ways that you can still get in your needed exercise and you’ll no longer have the gym membership fees to worry about.

Drop the Cell Phone

While it might not be possible to get rid of your cell phone completely (but probably more realistic than you realize), you can still get rid of the expensive monthly charges and switch to prepaid service.

Cancel Magazine Subscriptions

Many magazines will refund your money for un-mailed issues and the chances are that you can probably read many of them online, so you can still get your fill of them.

Sell a Car

If you aren’t quite ready to sell a car but can get by with one (or none), park the car and remove the plates. You won’t have to pay for insurance that way.

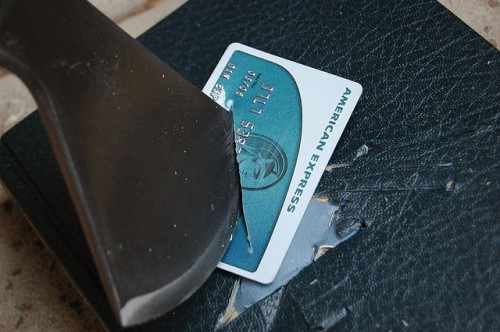

Ask for Lower Interest Rates

Call your credit card company and ask if you can get a lower rate. A lot will depend on the bank that has issued the card and your payment history, but if you get them to lower the interest rate, you instantly cut your expenses. If you don’t, it only takes a few minutes of your time to try.

Unplug and Turn Off Any Electrical Appliance

or lamp that’s not in use. Use power strips to make it easier to completely turn off items that consume power even when off.

Take Shorter Showers

An easy way to accomplish this is to place a timer in the shower room and set it when you get in. This will remind you when your time is up so that you use less water and save money, rather than take those long, extended showers.

Only Do Full Loads

Do laundry or dishes only when you have full loads. There are plenty of other easy ways to quickly reduce the costs associated with your clothes washing to save money.

Line Dry Clothes

take the clothes dryer completely out of the equation and save money on electricity. If this isn’t an option, there are plenty of dryer tips that can help you reduce expenses associated with drying your clothes.

Set the Thermostat

Keep the house warmer or cooler than usual. Put on a sweater or turn on a fan instead of ratcheting up the thermostat. If you haven’t done so already, invest in a programmable thermostat which will pay for itself and reduce your heating and cooling costs.

Stop Eating Out

When this is mentioned, most people think about dinner at restaurants, but it shouldn’t stop there. You can not only stop eating meals out, but also stop getting coffees, pastries, and other snacks away from home.

Buy Generic or on Sale Only

When times are tough, brand loyalty needs to go. Buy the least expensive brand you can get. You may end up being surprised to find that many generic products these days hold up well against their named brand equivalents.

Modify Your Insurance

Call your insurance agent and ask if there are any discounts which you aren’t already receiving. If not, shop around. Ask about raising your deductibles (but always make sure you have the means to pay if should you need to pay these deductibles). Make sure you’re not paying for double coverage and make sure you’re not paying for something you don’t need. Don’t drop your insurance altogether. That’s asking for trouble. Many insurers will send you a check, prorated for any overpayment you’ve already made if you modify your policy and it reduces your premium.

Cancel Services

If you have a maid, landscaper, handyman or any other service provider, drop them — or at least look for less expensive alternatives. Many times you may be able to do these things yourself.

Stop Bad Habits

Expensive and bad habits such as drinking and smoking need to go, but aren’t limited to the classic bad habits that are often mentioned. This also includes your daily coffee habit or soda habit. It may even include your TV habit.

Drop Your Landline

If you can get by with cell phone service only, drop the landline.

Stop Shopping Recreationally

When you need to reduce expenses, you want to avoid putting yourself in tempting situations to spend when you shouldn’t. Don’t go to the stores if you don’t have to.

Make Shopping Lists and Stick to Them

This is a good piece of advice whether you need to quickly reduce expenses or not. Don’t buy any extras or anything that you don’t absolutely need.

Use Coupons

Coupons often get a bad wrap, but they can greatly reduce the amount you spend on your food, cleaning, and hygiene supplies. The key is learning how to use coupon properly. It also may be time to use all the extra stuff you have stored in the pantry that may otherwise go to waste.

Make Your Own Cleaning Products

Cleaning products can be quite expensive, but they don’t need to be. You can make your own cleaning products with vinegar and baking soda for pennies.

Stop Charitable Giving

I’m all for giving to charities and churches when you can afford it, but if you can’t afford it, stop. Instead, keep track of what you wanted to give so that when your financial situation is better, you can make up for it then.

Renegotiate Your Bills

many of your monthly bills can be negotiated, especially if you have reached the point where you are willing to cancel if they refuse. Call your phone, Internet, TV, cell phone, or trash providers and ask for a discount. Ask nicely and you might get a better deal.

Shop at Alternative Stores

Try the bread outlet, the ding and dent store, the dollar store, or the farmer’s market to see if you can get things that you have been purchasing for a better price. Give up an addiction to department or specialty stores and hit the big-box stores.

Cut Entertainment

No more movies or store bought books and DVD’s. Borrow from the library or friends, instead. If you have to go out, look for free options.

Cancel Any “Miscellaneous” Subscriptions

Subscriptions to websites for additional content, gaming sites, satellite radio, movie rental sites, book/movie/music clubs, golf fees, and other sneaky subscriptions add up. Cancel them all.

Get Rid of Bank Fees

If you’re paying fees to your current bank, switch to a bank that offers free checking and no fees. Credit unions are a good place to start.

Watch the Kids

Kids sometimes rack up large bills on music, gaming or social networking websites. If you’ve given them access to your credit card, revoke it.

Shelve the Hobbies

Stop paying for any hobby related expenses for a while or find out creative ways that you can do them for no cost (or even make a little money at them)

Reduce Speed or Eliminate the Internet

There a re more and more options to get free Internet access these days, Use public terminals or WiFi if you have to for a while.

Drive Less

Combine errands and eliminate unnecessary trips to save on fuel. For shorter trips, consider taking the bike out to get to your destination.

Eliminate recurring expenses

Check your credit card statement for any recurring expenses. If there are any charges that appear every month, chances are it’s for some service that is auto-billing you. Cancel anything that you find, particularly if you’re not using it.

Check Your Bills Carefully

Mistakes creep into bills and if you don’t catch them, you may end up paying more for something for months. Check your credit card for anything you didn’t authorize. Check your phone bill to make sure services haven’t been added without your consent. Check your power and water bills to make sure your meters are being read correctly.

Put the Kids on the Bus

In our area, the school system provides bus service, paid for with taxpayer money. But many parents drive their kids to and from school because it’s “convenient” and Junior doesn’t have to get up as early. It’s also expensive because it wastes gas. You’re already paying for the bus. You might as well kick Junior out of bed early and use it. Use the gas money you’re saving for more important things.

Your expenses are not as fixed as you may think they are. There are plenty of ways to quickly cut your cost of living, in most cases. Sure, some of them might be painful but you have to ask yourself if the cuts are more or less painful than living in debt.

(Photo courtesy of danesparza)

Jennifer Derrick is a freelance writer, novelist and children’s book author. When she’s not writing Jennifer enjoys running marathons, playing tennis, boardgames and reading pretty much everything she can get her hands on. You can learn more about Jennifer at: https://jenniferderrick.com/.

Comments