Long term lurker, first time poster.

So, am looking for advice here on what to do.

Am 48, wife is 51. Combined income is around 150K, but a lot of that is OT which can be stopped at any time. I'm on a salary of approx 85 k, wife works part time, her salary is around 40k.

So, my question is, where do I invest?. Our house will be fully paid off by the end of the year, and we're sitting on retirement funds ( 401 k, IRA, ESPP) of around 700 k. Once the mortgage is cleared we'll have no debt, outside of everyday living expenses like utilities and food. We have about 40 k in cash. I max out 401 k and IRA, my wife can only contribute a max of 30% of her salary to her 401 k, which she does, and she does max out her IRA. We have one son who is grown up and living out of state.

With no mortgage payment starting next year, ( current mortgage payment is $1535 a month), should I continue to invest in stocks, or should I diversify into other income streams like property? Is there anything else I should consider besides property?

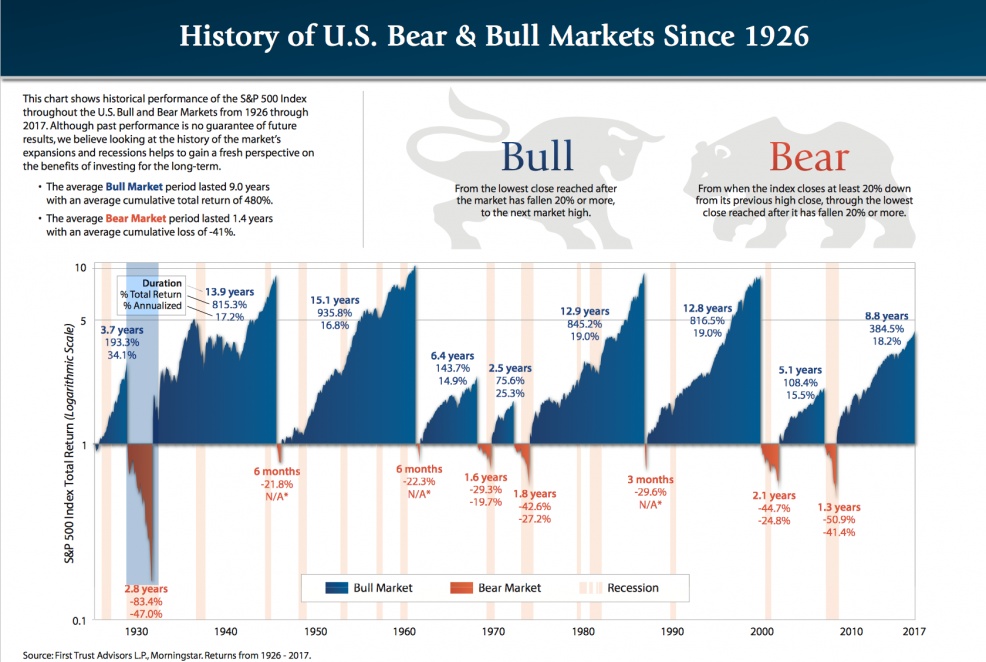

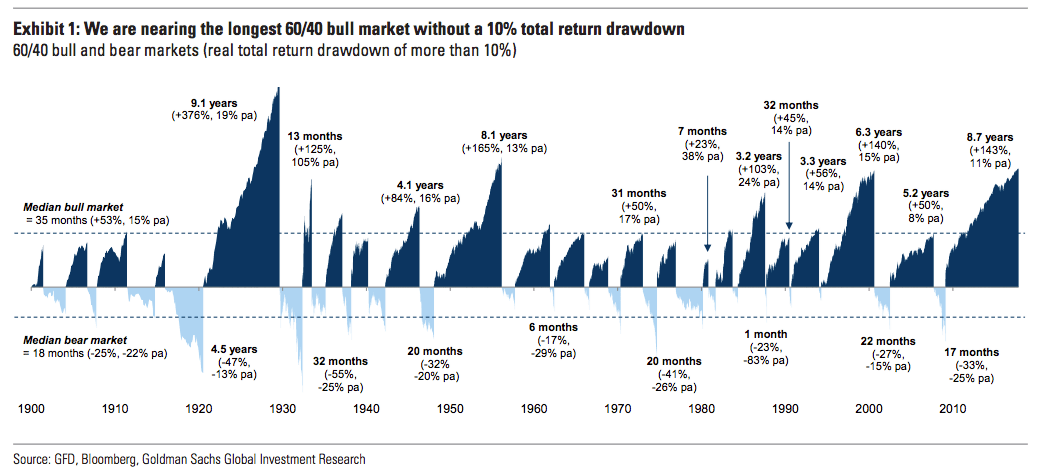

My concern is that although our retirement funds are spread out between indexed funds, some self selected stocks and target retirement IRA funds, if the stock market takes a nose dive, we'll be hit hard.

Both my wife and I hope to retire when we each hit 62, so if I need to diversify I'm thinking it'll need to be done soon.

Thanks in advance for any suggestions.

So, am looking for advice here on what to do.

Am 48, wife is 51. Combined income is around 150K, but a lot of that is OT which can be stopped at any time. I'm on a salary of approx 85 k, wife works part time, her salary is around 40k.

So, my question is, where do I invest?. Our house will be fully paid off by the end of the year, and we're sitting on retirement funds ( 401 k, IRA, ESPP) of around 700 k. Once the mortgage is cleared we'll have no debt, outside of everyday living expenses like utilities and food. We have about 40 k in cash. I max out 401 k and IRA, my wife can only contribute a max of 30% of her salary to her 401 k, which she does, and she does max out her IRA. We have one son who is grown up and living out of state.

With no mortgage payment starting next year, ( current mortgage payment is $1535 a month), should I continue to invest in stocks, or should I diversify into other income streams like property? Is there anything else I should consider besides property?

My concern is that although our retirement funds are spread out between indexed funds, some self selected stocks and target retirement IRA funds, if the stock market takes a nose dive, we'll be hit hard.

Both my wife and I hope to retire when we each hit 62, so if I need to diversify I'm thinking it'll need to be done soon.

Thanks in advance for any suggestions.

Comment