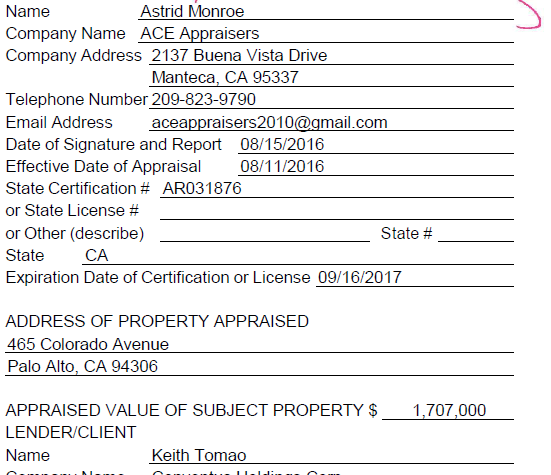

Recall we had a thread about using home value as part of retirement plan. And I made the argument to Singuy that many average home owners in HCOLA are using that to fund retirement. I can easily see the argument that it's shouldn't be such a disconnect in home prices across the US.

But did you see the graphic

That in 30 years SF home prices went up 557%? Then the areas that gained the most?

I pointed out that in HCOLA you use more of your income to own but then I've seen a lot of my family members have ridiculous returns on their homes. And that is funding retirement.

I like the idea of living in a LCOLA but sometimes you get stuck. And why pay the price to live in a HCOLA? There are reasons other than money but I'm also sure that perhaps it's not such a big discrepancy as people point out.

But did you see the graphic

That in 30 years SF home prices went up 557%? Then the areas that gained the most?

I pointed out that in HCOLA you use more of your income to own but then I've seen a lot of my family members have ridiculous returns on their homes. And that is funding retirement.

I like the idea of living in a LCOLA but sometimes you get stuck. And why pay the price to live in a HCOLA? There are reasons other than money but I'm also sure that perhaps it's not such a big discrepancy as people point out.

Comment