Came across this article, it is pre-Covid 19 - but still is an interesting view at how different generations perceive the 'rich life'.

--------------------------------------------------------------------------------------------------------------------

How Much Money Do You Need to Be Wealthy in America?

A few million should do it. But for some, it’s not just about the cash—it’s what you do with it.

By Suzanne Woolley

May 15, 2018, 4:00 AM PDT

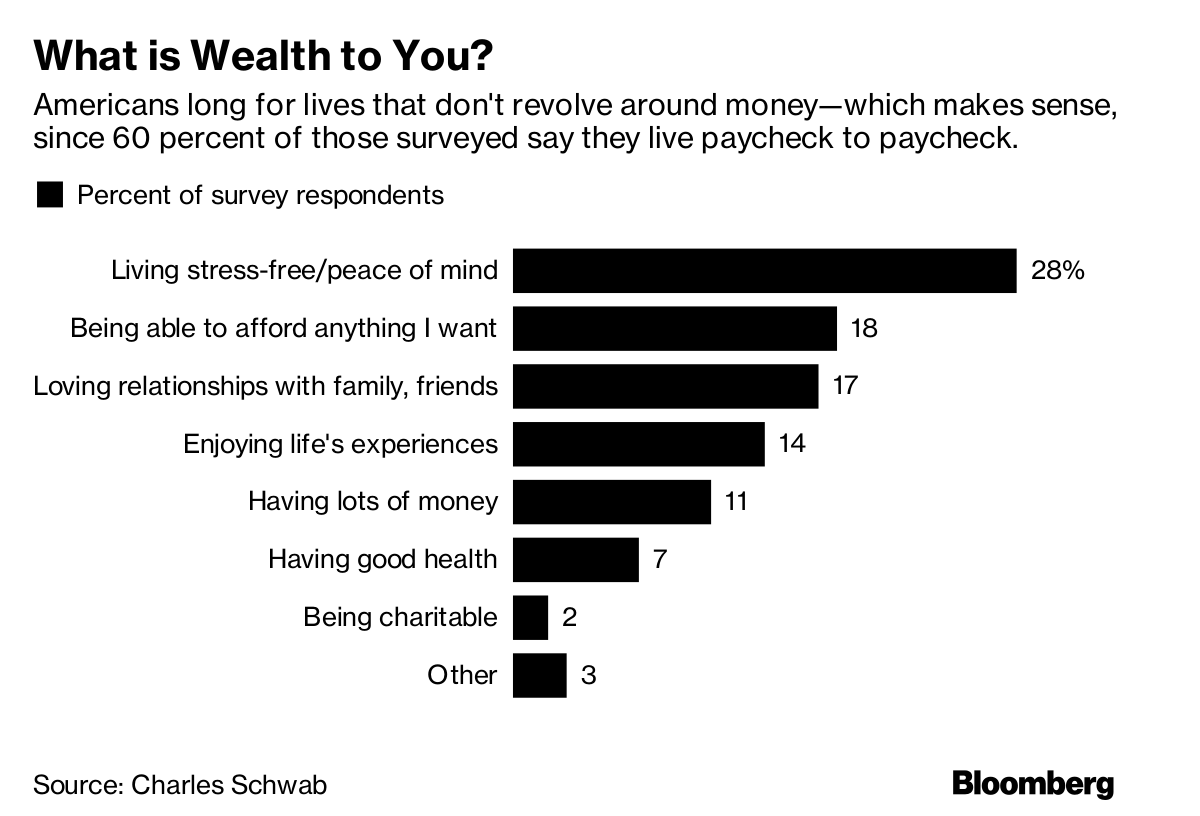

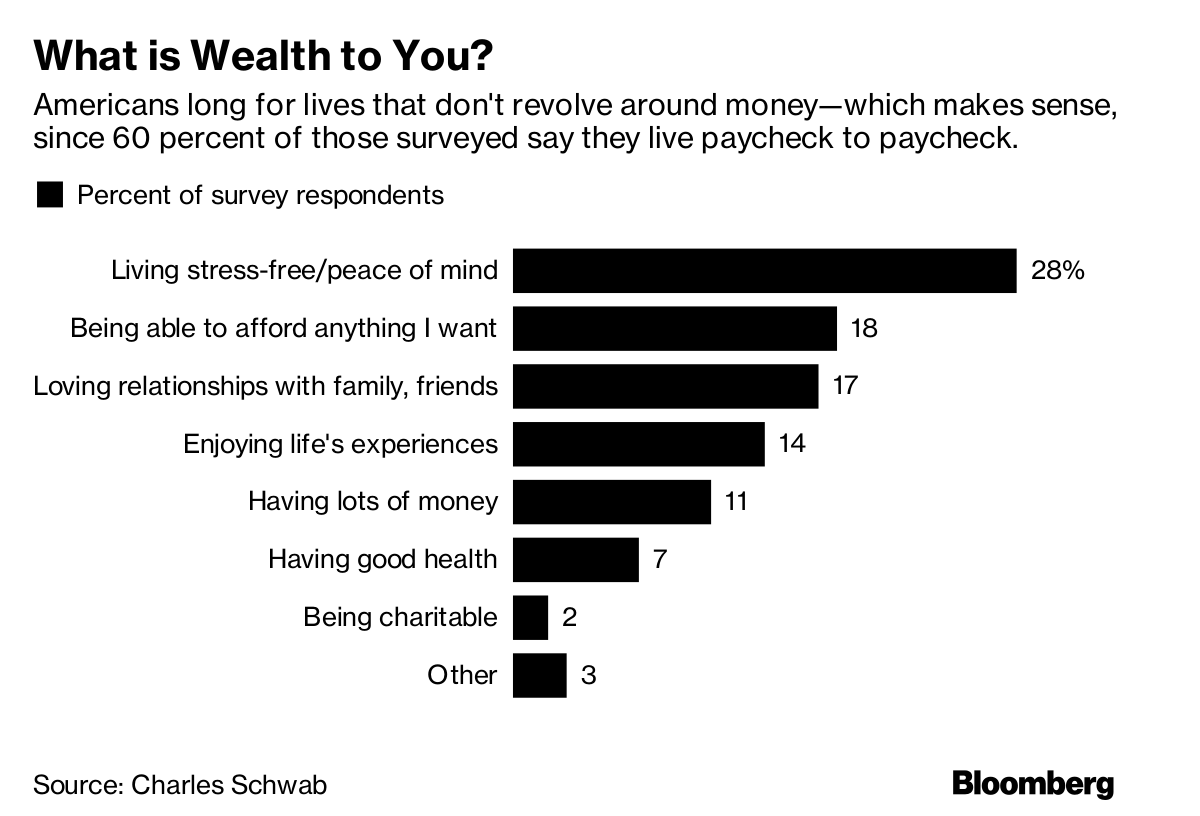

Many Americans cite leading a stress-free life and having “peace of mind” as their personal definition of wealth. That doesn’t sound too money-centric on the face of it—until you consider that money, or specifically the lack of it, is a major source of stress.

Americans don’t like to admit that assets can buy happiness—just 11 percent of those surveyed for the second annual Modern Wealth Index from Charles Schwab chose “having lots of money” as their definition of wealth. But while most respondents selected more high-minded concepts as their keys to contentment, they weren’t afraid to put a number on what they needed to get there.

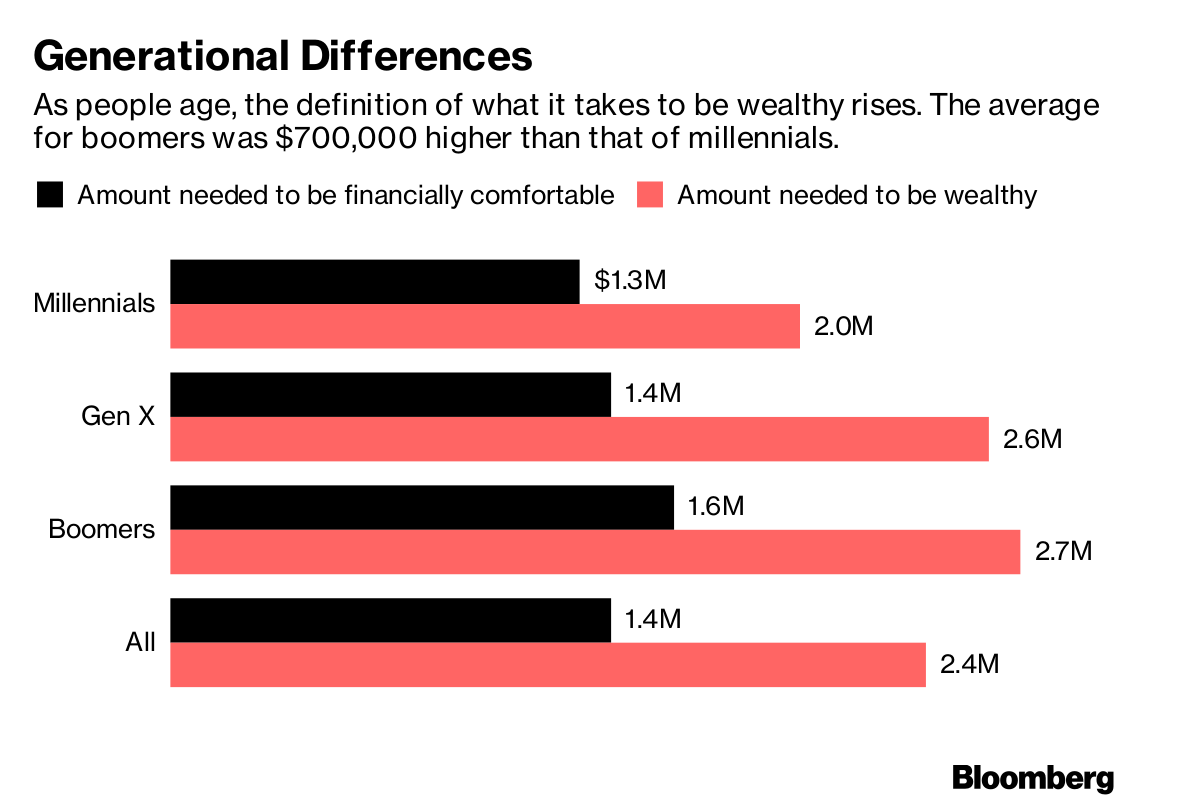

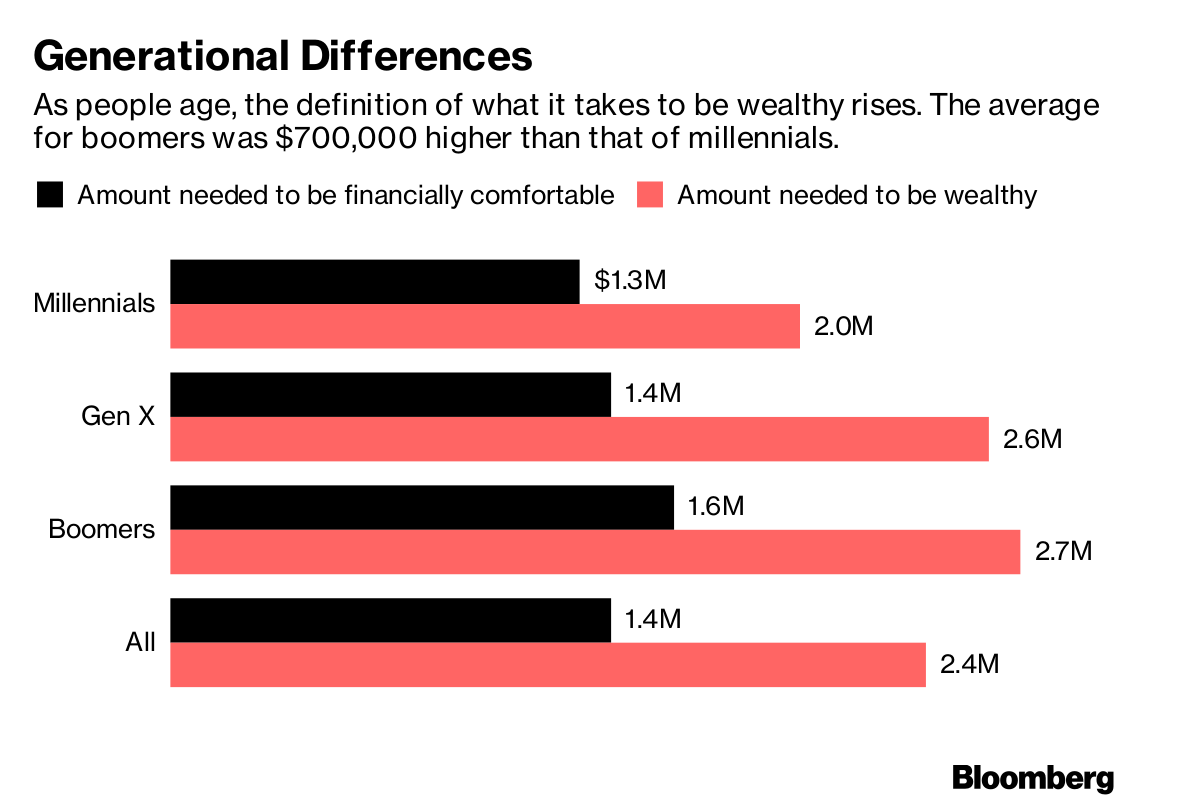

To be financially comfortable in America today requires an average of $1.4 million, up from $1.2 million a year ago, according to the survey. The net worth needed to be “wealthy”? That’s an average $2.4 million, the same as last year in the online survey of 1,000 Americans between age 21 and 75.

There were some heartening signs amid the numbers. While 18 percent defined wealth as being able to afford anything they desired, 17 percent said it was “loving relationships with family and friends.” That jibes with how Joe Duran, chief executive officer of money manager United Capital, said he likes to think of “wealth.” After building and selling his first company, “I realized that money is nothing more than fuel,” he said. “It is a resource that lets you have choices, but if you don’t think about what you are working for, you will die rich but not live rich.”

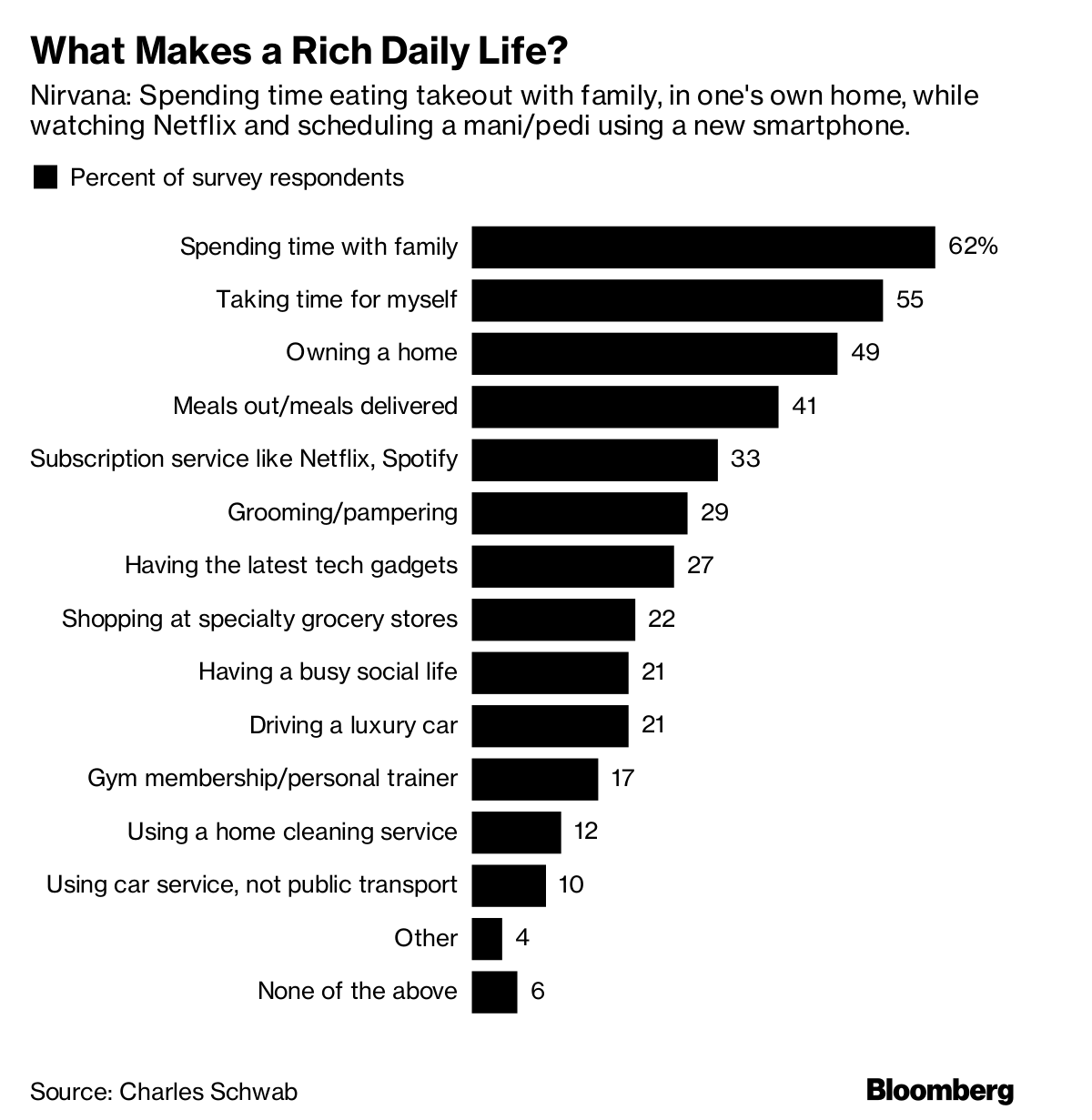

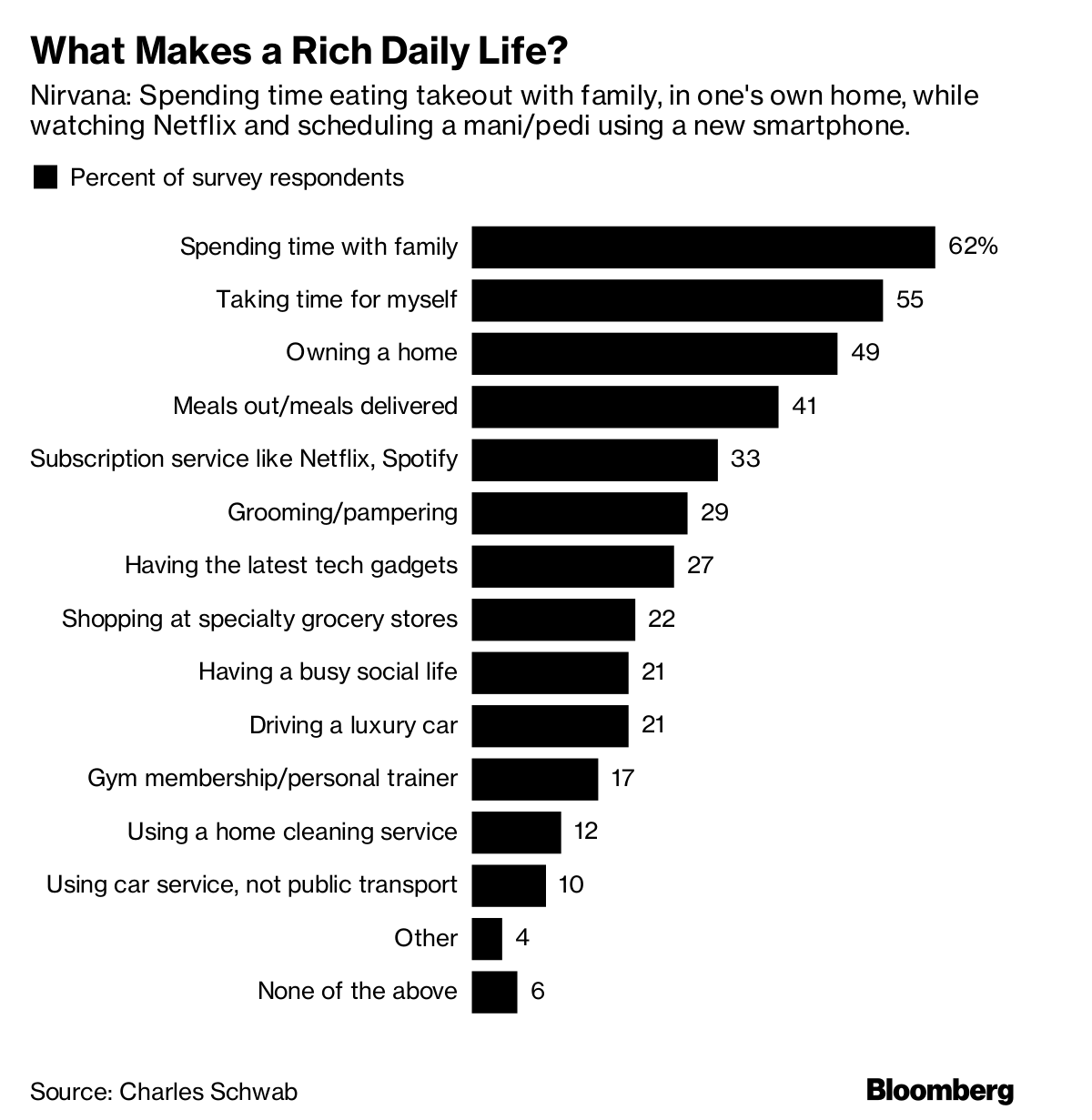

The survey asked people to choose which of the below statements came closest to their personal definition of wealth. When asked about what made respondents feel “wealthy” in their daily lives, the survey found that spending time with family was most commonly cited, at 62 percent overall. That was followed by what can be the most elusive of things, cited at about the same level across generations: “taking time for myself,” which came in at 55 percent. Hard to do either of those without some bank, though.

Life’s little luxuries matter, too—but they are called “luxuries” for a reason. Having meals out or food delivered made 41 percent of people feel “wealthy” in their daily lives. Even services such as Netflix, Spotify or Amazon Prime made life feel richer for an overall 33 percent—particularly for millennials, at 44 percent, compared with 29 percent and 23 percent for Generation X and baby boomers, respectively. Write-in comments for what made people feel “wealthy” included “access to healthcare,” “being able to help close friends and family financially” and “just waking up in the morning.” Only one of those doesn’t require money—sort of.

Millennials displayed some youthful optimism when it came to their financial future. Some 64 percent of twenty- and thirty-somethings believe they’ll be wealthy (the cash kind) at some point in their lives, compared with 22 percent of boomers. Maybe better financial habits will help that happen, since more millennials than boomers said they regularly rebalance their portfolio—49 percent compared with 43 percent, respectively. The same percentage of millennials and boomers, 24 percent, felt “very confident” about reaching financial goals.

In line with many other surveys put out by financial services firms, the Schwab survey stresses how people who have a written financial plan feel more stable and are more on top of their daily finances. Some 52 percent of boomers, however, said they didn’t have a plan because they didn’t have enough money to need a plan. People that chose “other” to explain why they lacked a financial plan wrote in responses such as “I have trust issues with financial people, especially after the 2008 crisis” and “all my information has been compromised by criminals.” Not a lot of “peace of mind” there.

Still, in these troubled times, there is hope. The survey found that the American Dream is not dead, at least the one that dictates that making money is indeed the path to bliss. Some 49 percent of respondents said that saving and investing is “the key to wealth,” with another 40 percent choosing “hard work.”

Eleven percent, however, cited luck.

Link to original article here.

--------------------------------------------------------------------------------------------------------------------

How Much Money Do You Need to Be Wealthy in America?

A few million should do it. But for some, it’s not just about the cash—it’s what you do with it.

By Suzanne Woolley

May 15, 2018, 4:00 AM PDT

Many Americans cite leading a stress-free life and having “peace of mind” as their personal definition of wealth. That doesn’t sound too money-centric on the face of it—until you consider that money, or specifically the lack of it, is a major source of stress.

Americans don’t like to admit that assets can buy happiness—just 11 percent of those surveyed for the second annual Modern Wealth Index from Charles Schwab chose “having lots of money” as their definition of wealth. But while most respondents selected more high-minded concepts as their keys to contentment, they weren’t afraid to put a number on what they needed to get there.

To be financially comfortable in America today requires an average of $1.4 million, up from $1.2 million a year ago, according to the survey. The net worth needed to be “wealthy”? That’s an average $2.4 million, the same as last year in the online survey of 1,000 Americans between age 21 and 75.

There were some heartening signs amid the numbers. While 18 percent defined wealth as being able to afford anything they desired, 17 percent said it was “loving relationships with family and friends.” That jibes with how Joe Duran, chief executive officer of money manager United Capital, said he likes to think of “wealth.” After building and selling his first company, “I realized that money is nothing more than fuel,” he said. “It is a resource that lets you have choices, but if you don’t think about what you are working for, you will die rich but not live rich.”

The survey asked people to choose which of the below statements came closest to their personal definition of wealth. When asked about what made respondents feel “wealthy” in their daily lives, the survey found that spending time with family was most commonly cited, at 62 percent overall. That was followed by what can be the most elusive of things, cited at about the same level across generations: “taking time for myself,” which came in at 55 percent. Hard to do either of those without some bank, though.

Life’s little luxuries matter, too—but they are called “luxuries” for a reason. Having meals out or food delivered made 41 percent of people feel “wealthy” in their daily lives. Even services such as Netflix, Spotify or Amazon Prime made life feel richer for an overall 33 percent—particularly for millennials, at 44 percent, compared with 29 percent and 23 percent for Generation X and baby boomers, respectively. Write-in comments for what made people feel “wealthy” included “access to healthcare,” “being able to help close friends and family financially” and “just waking up in the morning.” Only one of those doesn’t require money—sort of.

Millennials displayed some youthful optimism when it came to their financial future. Some 64 percent of twenty- and thirty-somethings believe they’ll be wealthy (the cash kind) at some point in their lives, compared with 22 percent of boomers. Maybe better financial habits will help that happen, since more millennials than boomers said they regularly rebalance their portfolio—49 percent compared with 43 percent, respectively. The same percentage of millennials and boomers, 24 percent, felt “very confident” about reaching financial goals.

In line with many other surveys put out by financial services firms, the Schwab survey stresses how people who have a written financial plan feel more stable and are more on top of their daily finances. Some 52 percent of boomers, however, said they didn’t have a plan because they didn’t have enough money to need a plan. People that chose “other” to explain why they lacked a financial plan wrote in responses such as “I have trust issues with financial people, especially after the 2008 crisis” and “all my information has been compromised by criminals.” Not a lot of “peace of mind” there.

Still, in these troubled times, there is hope. The survey found that the American Dream is not dead, at least the one that dictates that making money is indeed the path to bliss. Some 49 percent of respondents said that saving and investing is “the key to wealth,” with another 40 percent choosing “hard work.”

Eleven percent, however, cited luck.

Link to original article here.

.

.

Comment