Originally posted by disneysteve

View Post

Logging in...

Maxed my 401k for the year

Collapse

X

-

There is a salary cap on 401k contributions. Once you reach $285,000 in salary, you can no longer contribute to a 401k, even if you haven't contributed the full $19,500 (+6,500 for catchup). So I have to make sure I withhold enough to get to 19,500 (+6,500) before I get to $285,000 salary. This works fine because I withhold 7%, so I hit the max contributions at about the same time I hit the max salary. 285,000 * 7% = $19,950, so I withhold 7%. Sometimes I hit the max in April because I get my bonus in March.

-

-

Ah, gotcha. My gross is lower than the cap so I wasn't aware of that issue. Even if I pickup a bunch of per diem shifts, I wouldn't run up against that (and thanks to COVID I've really had no desire to work any more than I absolutely have to so this year's income will likely be lower than last year's).Originally posted by corn18 View Post

There is a salary cap on 401k contributions. Once you reach $285,000 in salary, you can no longer contribute to a 401k, even if you haven't contributed the full $19,500 (+6,500 for catchup). So I have to make sure I withhold enough to get to 19,500 (+6,500) before I get to $285,000 salary.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

Do not rely on those 401k plan calculators, they are for info only, and many times incorrect.Originally posted by disneysteve View PostNow I'm really confused.

I went to the website to change my contribution from 13% to 11%. There is a graph showing YTD contributions by employee and employer. Mine says $26,000, which is correct. The Employer section says the match is $7,358.75 but my latest paycheck only says $4,774.12. That larger amount is 3% of my gross YTD, meaning the match didn't stop at $19,500 even though the paychecks make it appear that it did.

Is there any reason the amount on the paychecks would be wrong?

I mentioned it before, but I am a profit sharing plan/401k administrator for my company's plan. I am familiar with a lot of these types of issues. The plan documents are what you should rely on. Consult with your plan administrator or custodian. Nowadays, unless the plan is old school and neglected, it will most likely have a true-up provision. Unusual for it not to.

I will say that match/no match, timing of maxing contributions, etc are entirely an upper middle class and up problem. lol These issues are generally a good problem to have.Last edited by ~bs; 10-23-2020, 10:25 PM.

Comment

-

-

That usually isn't much of an issue for highly compensated employees. Like I mentioned, people with this "problem" can max their 401k contribution in a single paycheck.Originally posted by corn18 View Post

There is a salary cap on 401k contributions. Once you reach $285,000 in salary, you can no longer contribute to a 401k, even if you haven't contributed the full $19,500 (+6,500 for catchup). So I have to make sure I withhold enough to get to 19,500 (+6,500) before I get to $285,000 salary. This works fine because I withhold 7%, so I hit the max contributions at about the same time I hit the max salary. 285,000 * 7% = $19,950, so I withhold 7%. Sometimes I hit the max in April because I get my bonus in March.

Comment

-

-

It's not a calculator. It's when I go into my personal account breakdown of the contributions year to date. It shows each of my contributions and each of the matching contributions that have been made with the date and amount of each transaction.Originally posted by ~bs View Post

Do not rely on those 401k plan calculators, they are for info only, and many times incorrect.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

I'm intentionally NOT maxing out retirement.....and constantly double-guessing myself about it. This probably seems silly (again, "nice problem to have"), but I keep wringing my hands about it. 5-8 years back when I was finally able to max both my TSP & Roth IRA, I was super proud of myself for making it to that point, and saw continuing to do so as the only path ahead. Now, we're both 34 y/o, have almost $600k in retirement accounts, plus $500k between our primary & rental homes (no mortgages), and expect we'll be FI by around age 42 when I plan to retire from the military.

With retirement accounts only accessible after 59.5, building up so much in those retirement accounts has started to make me nervous, knowing that we'd be looking at 15+ years of semi-retirement without access to the bulk of our money. So for the last year or so, I've sorta settled on only doing ~15% of gross into retirement accounts (maxing TSP & IRAs would be ~20%), and pushing alot of additional money (another 15%) into taxable investments to build up a 'bridge account' to produce income (whether in RE or stock markets, likely both) for those interim years... But in spite of knowing that's the plan, knowing that we have a huge headstart on retirement, and all that..... It's still just emotionally hard for me to not max the retirement accounts, because I'm constantly telling people that maxing those out should be the goal. Feels hypocritical, and seems to go against common sense of taking advantage of the tax-free growth in my Roth TSP. I'm still not totally convinced that I've got either a right or wrong approach... Right now it's simply "AN approach."

I don't mean to side-track the thread... Sorta just commenting that maxing retirement is a tricky topic for me because of my somewhat unique personal situation... Maxing retirement may not always be the right goal, even though it's almost always a very good goal. (Maybe I'll eventually convince myself of that

)

)

Comment

-

-

I think you're absolutely right about not tying up money in an account you can't access for 15 years after you're anticipated retirement date. However, remember that you can withdraw contributions to a Roth any time without penalty. You just can't touch the earnings early. (I don't know the TSP rules.) That being said, I'd keep maxing the Roth since you can get to that money if you need to.Originally posted by kork13 View PostI'm intentionally NOT maxing out retirement.....and constantly double-guessing myself about it.

And you're definitely right that sometimes the rules of thumb don't fit your situation. For me, I'm 56 and not planning to retire for a few more years. The 59.5 rule isn't relevant, plus we have plenty of money not in retirement accounts if, for some reason, I was to retire early. So maxing the 401k is a no-brainer.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

I never dreamed a plan would just shut off the contributions when that level was reached (according to the IRS website, it is not common). I wonder if it is accounting software limitations unique to your plan (or they just haven't updated the plan rules)?Originally posted by corn18 View Post

There is a salary cap on 401k contributions. Once you reach $285,000 in salary, you can no longer contribute to a 401k, even if you haven't contributed the full $19,500 (+6,500 for catchup). So I have to make sure I withhold enough to get to 19,500 (+6,500) before I get to $285,000 salary. This works fine because I withhold 7%, so I hit the max contributions at about the same time I hit the max salary. 285,000 * 7% = $19,950, so I withhold 7%. Sometimes I hit the max in April because I get my bonus in March.

https://www.irs.gov/retirement-plans...e-annual-limit

I wonder if all the limitations your plan has (such as being locked into the election early on)--has a negative effect on the overall participation and contribution amount in the 401k plan?

Comment

-

-

Our ROTH 401K has limited options so it's never made sense to max it out beyond the match. But since I began reading about the Boglehead philosophy, and since VTSAX is offered in the plan, I told DH to start max contributing to it.

As he doesn't make a lot of money, it's been hard maxing out everything on top of saving for a down payment but it needs to be done. Like kork, there's a lot of hand wringing in our house too, but for the opposite reason. Ugh!

Comment

-

-

I guess where I come down on it is just being deliberate with your planning and doing what makes sense for your situation. Obviously for many folks who don't earn alot, maxing out a 401k (or sometimes even just a pair of Roth IRAs) can be an unreachable task. If you earn $40k/yr, I'd call it a win to just max out a Roth IRA. It think in general, maxing a 401k doesn't really become feasible for most people until they're earning around $100k+. In personal finance, there's alot of personal factors involved. What's important is knowing and sticking to your priorities & goals. It's easy to start comparing yourself to others, which often tends to be unhelpful. Another factor to consider, maxing a 401k may not even be necessary for many folks, because they won't require a large income in retirement. I think sometimes we get wrapped up in doing something simply because it's an available option...."Why climb the mountain? Because it's there."Originally posted by Scallywag View PostOur ROTH 401K has limited options so it's never made sense to max it out beyond the match. But since I began reading about the Boglehead philosophy, and since VTSAX is offered in the plan, I told DH to start max contributing to it.

As he doesn't make a lot of money, it's been hard maxing out everything on top of saving for a down payment but it needs to be done. Like kork, there's a lot of hand wringing in our house too, but for the opposite reason. Ugh!

Comment

-

-

I agree. Last year was the first time I maxed a 401k (I've only had a 401k since 2016 and wasn't full time at that job until end of 2017). We've always maxed both of our Roths but there were some years when even that was a bit of a stretch. You just do the best you can with what you've got to work with.Originally posted by kork13 View PostObviously for many folks who don't earn alot, maxing out a 401k (or sometimes even just a pair of Roth IRAs) can be an unreachable task. If you earn $40k/yr, I'd call it a win to just max out a Roth IRA. It think in general, maxing a 401k doesn't really become feasible for most people until they're earning around $100k+.

Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

Except there IS a mountain to climb at my house. It's saving for my son to inherit a large enough nest egg so that he can live comfortably all his life even if he doesn't make a dime in earnings himself due to his disability. That's where the "personal" comes in here.Originally posted by kork13 View PostI guess where I come down on it is just being deliberate with your planning and doing what makes sense for your situation. Obviously for many folks who don't earn alot, maxing out a 401k (or sometimes even just a pair of Roth IRAs) can be an unreachable task. If you earn $40k/yr, I'd call it a win to just max out a Roth IRA. It think in general, maxing a 401k doesn't really become feasible for most people until they're earning around $100k+. In personal finance, there's alot of personal factors involved. What's important is knowing and sticking to your priorities & goals. It's easy to start comparing yourself to others, which often tends to be unhelpful. Another factor to consider, maxing a 401k may not even be necessary for many folks, because they won't require a large income in retirement. I think sometimes we get wrapped up in doing something simply because it's an available option...."Why climb the mountain? Because it's there."

Maxing out our ROTHs and the Coveralls is challenging. But what really is crushing is the saving for a large downpayment on top of all these. My daughter will not be able to add to her Coverdell once she turns 18 (in a couple of years now). Then that money can go into DH's 401K.

i plan to continue funding my son's Coverdell because it will be rolled over to his ABLE account when he turns 30.

We'll see.

Last edited by Scallywag; 10-24-2020, 12:32 PM.

Comment

-

-

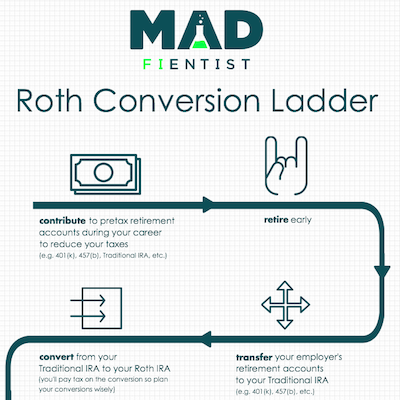

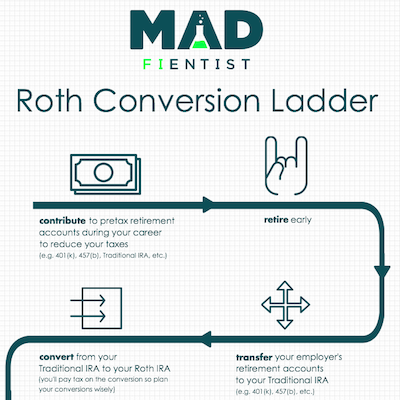

Read this. You might change your mind. Or not.Originally posted by kork13 View PostI'm intentionally NOT maxing out retirement.....and constantly double-guessing myself about it. This probably seems silly (again, "nice problem to have"), but I keep wringing my hands about it. 5-8 years back when I was finally able to max both my TSP & Roth IRA, I was super proud of myself for making it to that point, and saw continuing to do so as the only path ahead. Now, we're both 34 y/o, have almost $600k in retirement accounts, plus $500k between our primary & rental homes (no mortgages), and expect we'll be FI by around age 42 when I plan to retire from the military.

With retirement accounts only accessible after 59.5, building up so much in those retirement accounts has started to make me nervous, knowing that we'd be looking at 15+ years of semi-retirement without access to the bulk of our money. So for the last year or so, I've sorta settled on only doing ~15% of gross into retirement accounts (maxing TSP & IRAs would be ~20%), and pushing alot of additional money (another 15%) into taxable investments to build up a 'bridge account' to produce income (whether in RE or stock markets, likely both) for those interim years... But in spite of knowing that's the plan, knowing that we have a huge headstart on retirement, and all that..... It's still just emotionally hard for me to not max the retirement accounts, because I'm constantly telling people that maxing those out should be the goal. Feels hypocritical, and seems to go against common sense of taking advantage of the tax-free growth in my Roth TSP. I'm still not totally convinced that I've got either a right or wrong approach... Right now it's simply "AN approach."

I don't mean to side-track the thread... Sorta just commenting that maxing retirement is a tricky topic for me because of my somewhat unique personal situation... Maxing retirement may not always be the right goal, even though it's almost always a very good goal. (Maybe I'll eventually convince myself of that

)

)

401k can be viewed as tax advantages accounts. Not just retirement accounts. I have seen this mentioned on bogleheads quite a bit.

I watched $500k go to $320k in a week this year.

Find out how you can access retirement funds early (without paying any penalties) and learn the best withdrawal strategy for early retirees!

Find out how you can access retirement funds early (without paying any penalties) and learn the best withdrawal strategy for early retirees!

Comment

-

-

Thank you for sharing this link.Originally posted by Jluke View Post

Read this. You might change your mind. Or not.

401k can be viewed as tax advantages accounts. Not just retirement accounts. I have seen this mentioned on bogleheads quite a bit.

I watched $500k go to $320k in a week this year.

Find out how you can access retirement funds early (without paying any penalties) and learn the best withdrawal strategy for early retirees!

Find out how you can access retirement funds early (without paying any penalties) and learn the best withdrawal strategy for early retirees!

I want to comment on this: I did not realize that the entire amount I paid taxes on when I convert from traditional to a ROTH could be considered "contributions" and withdrawn completely penalty and tax free. I have only one traditional 401K and everything is ROTH. With the ROTH, you'd pay taxes on growth if you withdrew it before age 59-and-a-1/2 plus a 10% prepayment penalty, so it actually (unless I am misunderstanding something here), might be better to contribute to a TRADITIONAL IRA and then convert a little at a time so that we could avoid penalties if we withdraw in 5 years (but were under age 59-and-a-1/2)?

Did I understand this right?

Comment

-

Comment