What ever happened to Peer-to-Peer lending? When I first joined this forum there seemed to be several people who were investing in Peer-to-Peer lending. "Prosper" was one vehicle they were using. I think there were others, but I don't recall the names? Did P2P lending fizzle out with the great recession?

Logging in...

What ever happened to Peer-to-Peer lending?

Collapse

X

-

What ever happened to Peer-to-Peer lending?

"There is some ontological doubt as to whether it may even be possible in principle to nail down these things in the universe we're given to study." --text msg from my kid

"It is easier to build strong children than to repair broken men." --Frederick DouglassTags: None

-

-

Why would someone borrow money on a peer to peer lending site, when you can just start a GoFundMe page for any random reason & have random strangers shell out to cover the cost of your poor choices?

.... Wow, my cynic came out full-force there, sorry....

I know we have a couple members here who lent on one of them with good success, but as I recall, the quality of borrowers had gone down, fees from the platform had gone up, and it had lost some of its profitability (and thus appeal) as an alternative form of investment.

While I'm sure it's still there & available as an option, I've never had an appetite for that level of risk.

-

-

I stopped P2P. I did make decent money, but not really worth the hassle. I was with LC. To reduce the chances of investing in bad loans, you do need to go through and filter. If you buy whatever the platform suggests, you will end up with bad loans. I was with lending club.

Comment

-

-

I still have some money in peerstreet which lacks inventory from Covid with higher default rate, and lending club I'm which I wanted to an experiment by not reinvesting to see the overall returns after all loans are paid off or discharged. I only invest in terrible high interest rate loans from LC

7.2% average return from peerstreet.

6.8% return from LC

4 years with these platform.

Comment

-

-

Do these sites guarantee the money you put into them, or is it strictly upon the person you lend it to, to pay you back?

Personally I never liked the proposition of it all. If someone needs a $1,000 loan to start a business they should be out hustling to round it up. If they need $10,000 and they can't get a loan from a bank, there is a reason.

Comment

-

-

No guarantees so you are suppose to diversify as much as possible and use probability in your favor. You are like a credit card company the high interest rate is suppose to offset the bad loans and get you close to a 7% return.Originally posted by myrdale View PostDo these sites guarantee the money you put into them, or is it strictly upon the person you lend it to, to pay you back?

Personally I never liked the proposition of it all. If someone needs a $1,000 loan to start a business they should be out hustling to round it up. If they need $10,000 and they can't get a loan from a bank, there is a reason.

Comment

-

-

I am not really a fan of this kind of lending in a portfolio if there is no recourse to recover your loss. There is a very large historical correlation of unsecured high risk credit to fail. Jim Chanos achieved approximately half of his success targeting this sector for short selling. If you want high risk credit buy a pawn shop stock where the loan is backed by collateral.

Comment

-

-

Same here in NJ.Originally posted by bjl584 View PostIt's still around as far as I know.

I looked into investing in it, but at the time it was illegal in PA. It still might be. Not sureSteve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

I've peer-to-peer lending via Prosper.com since 2008.

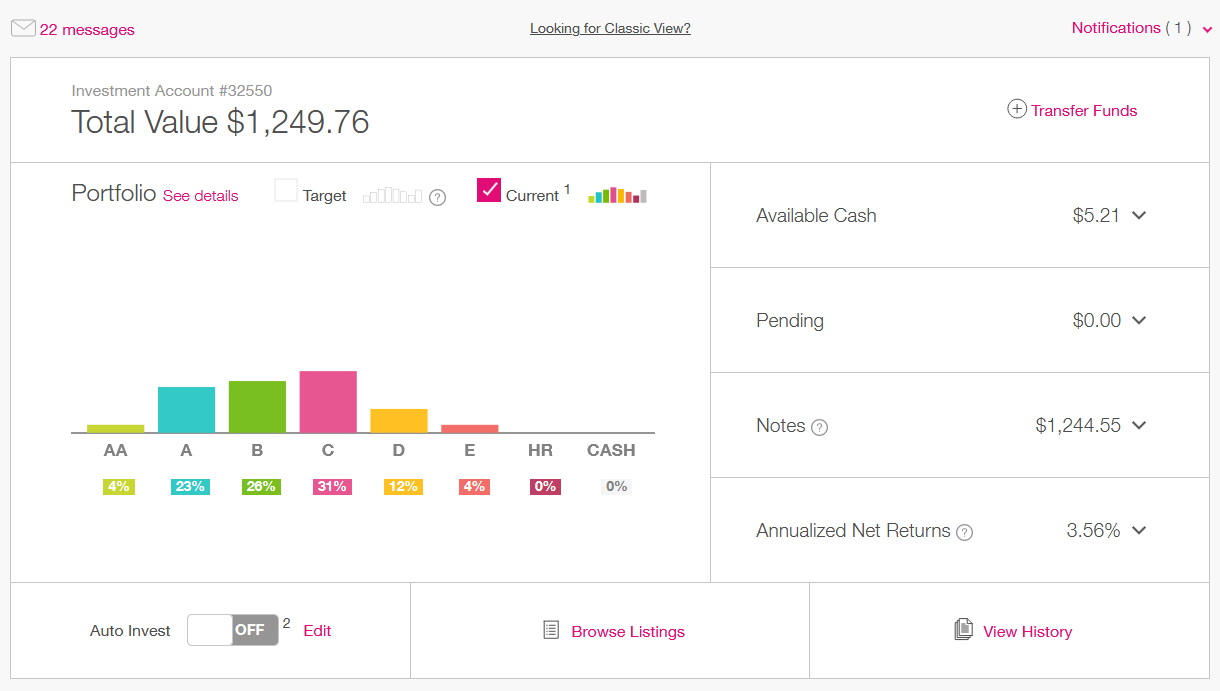

My holdings are pretty modest - I've got about $1,200 on their platform. Here is my dashboard for those on the forums who might be interested in having a look. The total value is $1,249.76, with annualized returns of 3.56 percent.

A few things:

First, my annualized net returns are a low 3.56% because when I got started, several of the loans I made went bad on the platform. From what I've read in the news and on the blogs that covered Prosper, this was a problem with the companies lending standards. From what I gather the SEC later got involved and forced them to tighten their rules.

Second, one reason why you haven't heard much about peer-to-peer lending is frankly it isn't clear if the industry is profitable. The two major companies in the US market are Prosper and Lending Club. Lending Club's stock has been on a long term decline and Prosper has had about 12 rounds of venture capital funding. While I'm not all that well versed in the ins and outs of angel investing and corporate valuations in the tech space, if these companies were making money, the market would be signaling differently. So, this means Lending Club's share price would be increasing and at some point Prosper would no longer need angel investors.

Also, Peer-to-peer loans generally are not a liquid asset class. Returns are totally dependent on borrowers repaying lenders, not on any kind of market action. At one point Prosper.com had tried to create a marketplace for the loans, but they weren't successful. Evidently the company assessed there wasn't enough demand to build the marketplace. It is possible a lack of legal clarity played a role as well.

There is some good academic research on returns and benefits associated with peer-to-peer lending. Namely:

1) Peer-to-peer lending does reduce your portfolio's volatility. It is basically an uncorrelated asset.

2) Peer-to-peer investors get returns that are generally high give the risk they take. (Source)

In terms of my own wealth building, I'll almost certainly be investing a modest amount moving forward. Probably $50 a month. If I can get my returns up to 7% I should have around $5,060.92 in 5 years.

james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

Yes, some people would just take the loan amount of $35k and walk away without making a single payment.Originally posted by JBinKC View PostI am not really a fan of this kind of lending in a portfolio if there is no recourse to recover your loss. There is a very large historical correlation of unsecured high risk credit to fail. Jim Chanos achieved approximately half of his success targeting this sector for short selling. If you want high risk credit buy a pawn shop stock where the loan is backed by collateral.

That is why it's important to filter loans. I always went for the highest interest rates and individuals with high verified income and no history of defaults. People that haven't previously defaulted are less likely to default in the future. The top rated loans at low interest rates don't make sense compared to the ones with higher interest rates. The somewhat lower default risk of the top rated loans didn't justify the much smaller interest rate. I did make a really good rate of return, even factoring in defaults +10%. Still, not worth the time invested, at least for me. Fun at first,then irritating afterwards.

Comment

-

-

~bs Jim Chanos! I saw your comment here and looked him up. Interesting guy. He made a lot of money shorting Enron and Hertz. He also teaches a class on financial fraud at Yale.

To the chagrin of many, he may also have a short position in Tesla.

Here is a sweet interview with the guy on the HedgeyeTV.

james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

I've been with Lending Club for almost ten years. Since I have had everything invested (which takes some months to get it all deployed and payments to start coming in), I have earned a steady 5-7% interest. What I have found is that you have to have a nice chunk of money in your account to balance the interest earned against the defaults. The first time I had a default, I took it totally personally and I was super mad. But over the years I have found I still make money. I'll earn $200 in interest, have $50 in defaults and my return is still 5-7%. I'm happy with that. Though I still think some of the people who default are total crooks who never intend to pay back the loans.

I focus on small loans in the A and B level of interest. Also, LC offers 36 and 60 month loans...I am getting closer to retirement so am going to focus on 36 month loans from now on.

Comment

-

-

Part of the junk thing about p2p lending is the best borrowers use the platform to improve their credit standing, then refinance into a lower interest rate loan. You can hardly blame them for doing what's financially best for their situation. BUT the investor takes a risk in investing in these loans, and it sucks that your "winners" pull out early, leaving you with other borrowers that are not as committed to paying down the loan and at higher risk of default.Originally posted by sblatner View PostI've been with Lending Club for almost ten years. Since I have had everything invested (which takes some months to get it all deployed and payments to start coming in), I have earned a steady 5-7% interest. What I have found is that you have to have a nice chunk of money in your account to balance the interest earned against the defaults. The first time I had a default, I took it totally personally and I was super mad. But over the years I have found I still make money. I'll earn $200 in interest, have $50 in defaults and my return is still 5-7%. I'm happy with that. Though I still think some of the people who default are total crooks who never intend to pay back the loans.

I focus on small loans in the A and B level of interest. Also, LC offers 36 and 60 month loans...I am getting closer to retirement so am going to focus on 36 month loans from now on.

Comment

-

-

I was with Lending Club since it started. I averaged around 9% interest, but then they got bigger and started "packaging" their better loans and selling them and leaving the lower-rated ones for their loyal customers.

I just received an email today that Lending Club is ending their Notes and peer-to-peer lending as they have bought a bank and are going in a different direction.

Comment

-

Comment