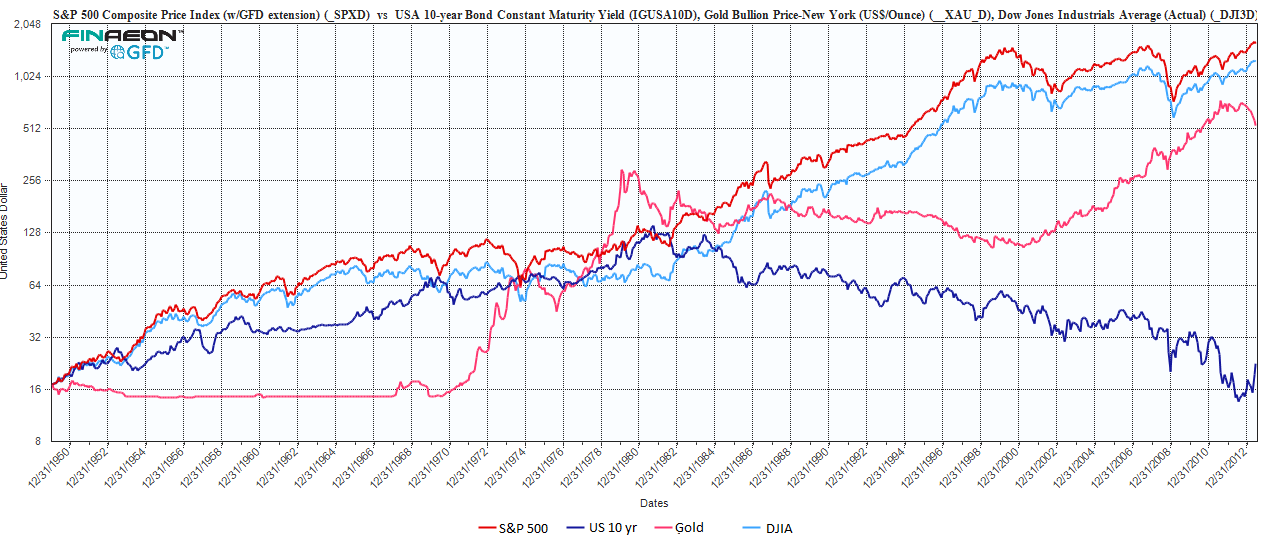

On a few recent podcasts, Dave has talked about investing and I've heard a little more detail about his thinking. He is almost entirely opposed to investing in bonds of any type regardless of your age. The explanation he gave was that if you look at the look term track record of the stock market and chart volatility and do the same for the bond market, the volatility graphs are very similar. Bonds are less volatile but not significantly so according to Dave. His thinking is that people buy bonds to get a safer, more stable, investment and that isn't really the case. And on top of that, the return is lower than stocks (we all agree on that point of course). So if you aren't getting less volatility and you're getting lower returns, why bother?

About the only time he recommends an investment that involves bonds his when he talks about Growth and Income or Balanced mutual funds which will hold a portion of their portfolio in bonds.

I'm certainly not agreeing with him or promoting his plan (100% stocks all the time for everyone) but I thought it was interesting to hear his reasoning. Thoughts?

About the only time he recommends an investment that involves bonds his when he talks about Growth and Income or Balanced mutual funds which will hold a portion of their portfolio in bonds.

I'm certainly not agreeing with him or promoting his plan (100% stocks all the time for everyone) but I thought it was interesting to hear his reasoning. Thoughts?

Comment