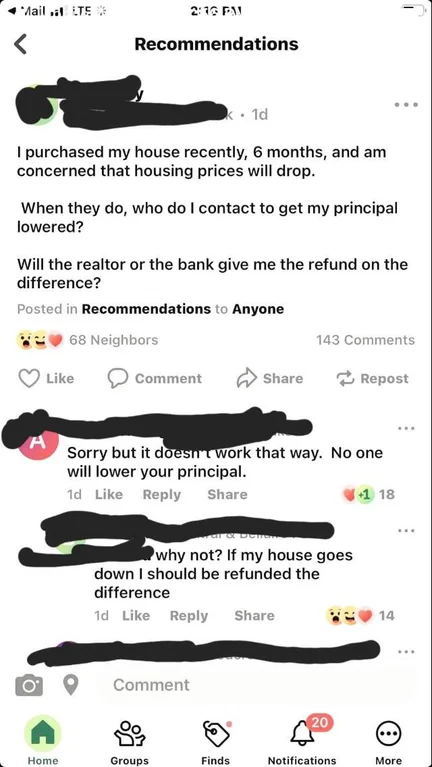

All,

I pulled this from Ramit Sathi's twitter feed.

Its a posting from the Costco subreddit on reddit:

And no, I don't think its a joke.

So, for all the lurkers on the forums out there, you can't get your principal lowered if the value of your home declines.

I pulled this from Ramit Sathi's twitter feed.

Its a posting from the Costco subreddit on reddit:

And no, I don't think its a joke.

So, for all the lurkers on the forums out there, you can't get your principal lowered if the value of your home declines.

Comment