I am 50. My wife is 47.

My dad is in Assisted Living with Alzheimer's. His total monthly expenses are about $7K a month (I pay sitters to come and visit with him to the tune of about $3K a month) His LTC policy pays about $3500 per month, and pension and SS pay another $4000 or so.

So...he's somewhat set for two more years until his LTC policy runs out. Then we have a shortfall. I've got plans for that in the works, but my goodness the LTC insurance has been a blessing.

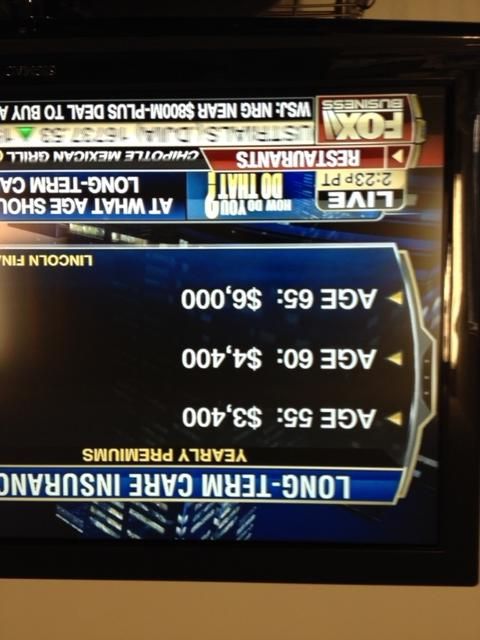

Today, we got a quote of $300 a month for a middle-of-the-road policy for both me and my wife. While it may be that we are fabulously wealthy at age 70 and it was the dumbest thing we ever bought, it also may be that we really need the benefit.

I suppose we could wait a few more years to buy this stuff (it gets more $$ expensive as you get older), but I'm kind of considering finding the money in our budget to buy it. The premiums are fully tax deductible as a business expense, which knocks the net down to around $220 a month.

Who wants to leave a mountain of ongoing health / home care expenses for their kiddos?

Am I on the wrong track here?

My dad is in Assisted Living with Alzheimer's. His total monthly expenses are about $7K a month (I pay sitters to come and visit with him to the tune of about $3K a month) His LTC policy pays about $3500 per month, and pension and SS pay another $4000 or so.

So...he's somewhat set for two more years until his LTC policy runs out. Then we have a shortfall. I've got plans for that in the works, but my goodness the LTC insurance has been a blessing.

Today, we got a quote of $300 a month for a middle-of-the-road policy for both me and my wife. While it may be that we are fabulously wealthy at age 70 and it was the dumbest thing we ever bought, it also may be that we really need the benefit.

I suppose we could wait a few more years to buy this stuff (it gets more $$ expensive as you get older), but I'm kind of considering finding the money in our budget to buy it. The premiums are fully tax deductible as a business expense, which knocks the net down to around $220 a month.

Who wants to leave a mountain of ongoing health / home care expenses for their kiddos?

Am I on the wrong track here?

because of your father, you are more educated on this topic than 90% of us here

because of your father, you are more educated on this topic than 90% of us here

Comment