Best deal was the HVAC from costco.

Logging in...

Wow....Costco Has Been Going Gangbusters

Collapse

X

-

Andddddd. here is their latest announcement. They're raising the quarterly dividend from 79 to 90 cents per share, or $3.60 on an annualized basis.

Here is the press release.

I just wish I had more shares, I was only able to get a couple of last year, and now the price has gone up 200%.

james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

Here are the latest numbers from Costco:

Source:Costco.com.ISSAQUAH, Wash., July 07, 2022 (GLOBE NEWSWIRE) -- Costco Wholesale Corporation (“Costco” or the “Company”) (Nasdaq: COST) today reported net sales of $22.78 billion for the retail month of June, the five weeks ended July 3, 2022, an increase of 20.4 percent from $18.92 billion last year.

For the forty-four weeks ended July 3, 2022, the Company reported net sales of $188.34 billion, an increase of 16.9 percent from $161.09 billion during the similar period last year.

These earnings numbers are a couple of percentage points better than previous quarters. And it looks like the long term impact of earnings growth is starting to be seen in the company's equity value. The stock's value has increased something like 300% since 2017.

I bought a bit more of their common stock yesterday morning. Its proven to be a good choice.

james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

People will shop more because they will cook more and eat out less. It's ridiculously expensive to eat out as a family nowOriginally posted by james.hendrickson View PostHere are the latest numbers from Costco:

Source:Costco.com.

These earnings numbers are a couple of percentage points better than previous quarters. And it looks like the long term impact of earnings growth is starting to be seen in the company's equity value. The stock's value has increased something like 300% since 2017.

I bought a bit more of their common stock yesterday morning. Its proven to be a good choice.

Comment

-

-

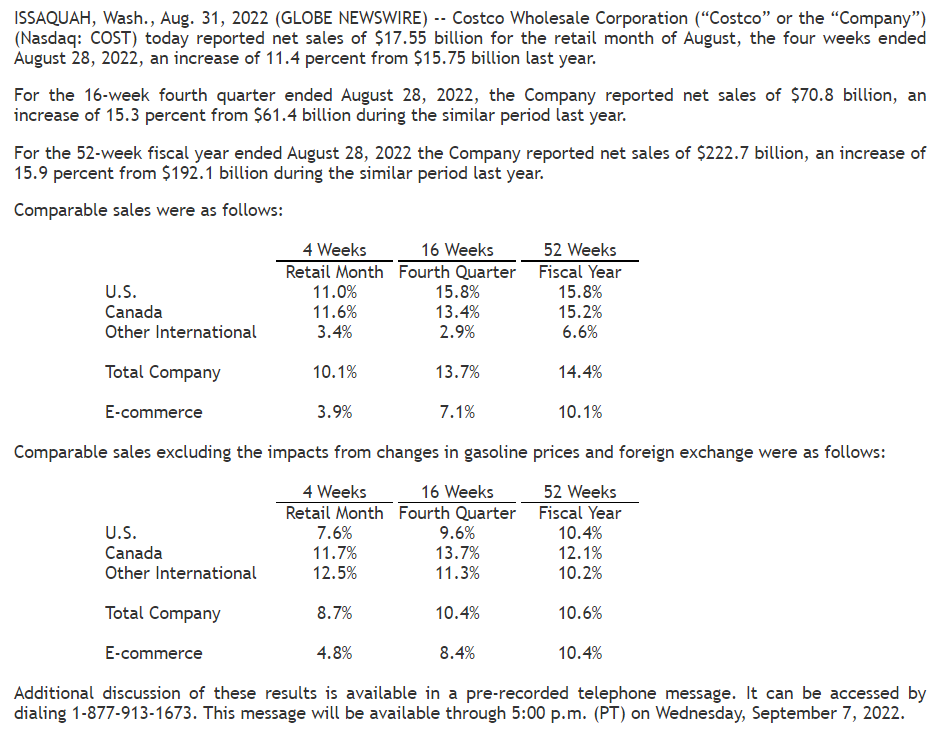

And their earning are up 15.3% this quarter. I should have bought more when I had the chance.

james.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

In case you all aren't paying attention - Costco is still producing outstanding earnings. Here is the their latest.

Also - every time I go there, their stores are full of customers.

Costco Wholesale Corporation Reports First Quarter Fiscal Year 2024 Operating Results And Announces A Special Cash Dividend Of $15 Per Share

12/14/2023

DOWNLOAD(OPENS IN NEW WINDOW)

ISSAQUAH, Wash., Dec. 14, 2023 (GLOBE NEWSWIRE) -- Costco Wholesale Corporation (“Costco” or the “Company”) (Nasdaq: COST) today announced its operating results for the first quarter (twelve weeks) of fiscal 2024, ended November 26, 2023.

For the first quarter the Company reported net sales of $56.72 billion, an increase of 6.1 percent from $53.44 billion for the first quarter of fiscal year 2023, ended November 20, 2022.

Net sales were benefited by approximately one-half to one percent in the U.S. and worldwide from the shift of the fiscal calendar, as a result of the fifty-third week in fiscal year 2023.

The following comparable sales reflect comparable locations year-over-year and comparable retail weeks.

Comparable sales for the twelve weeks ended November 26, 2023 were as follows:*Excluding impacts from changes in gasoline prices and foreign exchange.12 Weeks 12 Weeks Adjusted* U.S. 2.0% 2.6% Canada 6.4% 8.2% Other International 11.2% 7.1% Total Company 3.8% 3.9% E-commerce 6.3% 6.1%

Net income for the quarter was $1,589 million, $3.58 per diluted share, compared to $1,364 million, $3.07 per diluted share, last year. This year’s results included a tax benefit of $44 million, $0.10 per diluted share, related to stock-based compensation. Last year’s results included a charge of $93 million pre-tax, $0.15 per diluted share, primarily related to downsizing our charter shipping activities, and a tax benefit of $53 million, $0.12 per diluted share, related to stock-based compensation.

The Company also announced that the Board of Directors has declared a special cash dividend on Costco common stock of $15 per share, payable January 12, 2024, to shareholders of record as of the close of business on December 28, 2023. The aggregate amount of the payment will be approximately $6.7 billion.

Costco currently operates 871 warehouses, including 600 in the United States and Puerto Rico, 108 in Canada, 40 in Mexico, 33 in Japan, 29 in the United Kingdom, 18 in Korea, 15 in Australia, 14 in Taiwan, five in China, four in Spain, two in France, and one each in Iceland, New Zealand and Sweden. Costco also operates e-commerce sites in the U.S., Canada, the U.K., Mexico, Korea, Taiwan, Japan and Australia.

A conference call to discuss these results is scheduled for 2:00 p.m. (PT) today, December 14, 2023, and will be available via a webcast on investor.costco.com (click “Events & Presentations”).

Certain statements contained in this document constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For these purposes, forward-looking statements are statements that address activities, events, conditions or developments that the Company expects or anticipates may occur in the future. In some cases forward-looking statements can be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. These risks and uncertainties include, but are not limited to, domestic and international economic conditions, including exchange rates, inflation or deflation, the effects of competition and regulation, uncertainties in the financial markets, consumer and small business spending patterns and debt levels, breaches of security or privacy of member or business information, conditions affecting the acquisition, development, ownership or use of real estate, capital spending, actions of vendors, rising costs associated with employees (generally including health-care costs), energy and certain commodities, geopolitical conditions (including tariffs and the Ukraine conflict), the ability to maintain effective internal control over financial reporting, regulatory and other impacts related to climate change, public-health related factors, and other risks identified from time to time in the Company’s public statements and reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and the Company does not undertake to update these statements, except as required by law. Comparable sales and comparable sales excluding impacts from changes in gasoline prices and foreign exchange are intended as supplemental information and are not a substitute for net sales presented in accordance with GAAP.COST-EarnCONTACTS: Costco Wholesale Corporation Richard Galanti, 425/313-8203 David Sherwood, 425/313-8239 Josh Dahmen, 425/313-8254

COST-Compjames.c.hendrickson@gmail.com

202.468.6043

Comment

-

-

You know BJ, every time I go there, the place is packed. I think their earnings increases are real. And they likely have some room to grow...I just don't know if the multiple is worth it right now.Originally posted by bjl584 View PostStock up 50% in the past year. Trading near a 52 week high now.james.c.hendrickson@gmail.com

202.468.6043

Comment

-

Comment