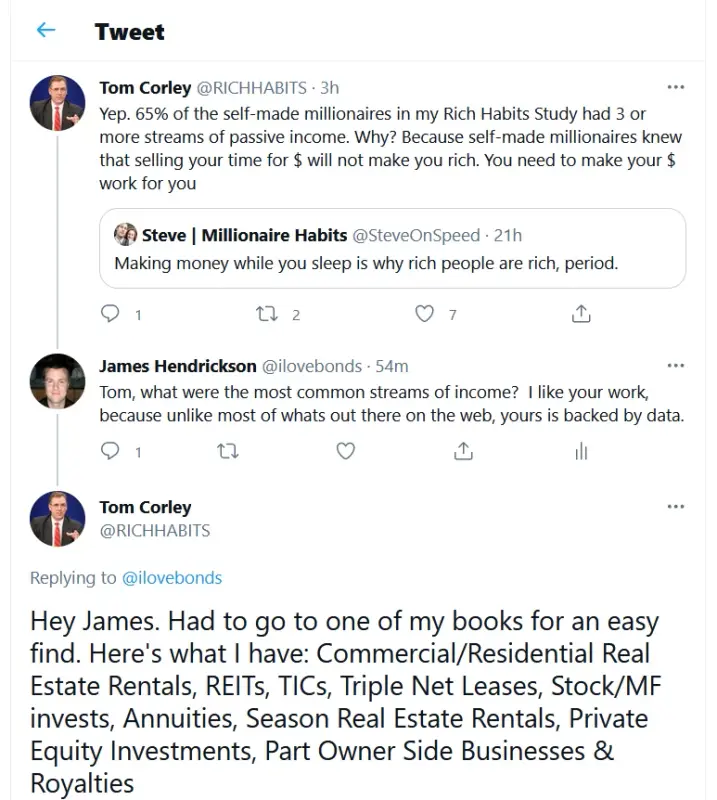

Supposedly millionaires have several streams of income.

I'm working on building out my dividend cash flow, so I wanted to ask you guys: How many streams of income do you have?

I'm working on building out my dividend cash flow, so I wanted to ask you guys: How many streams of income do you have?

(the w2 of course)

(the w2 of course)

Comment