What is your biggest financial blunder? For me it was hot rodding, modifying and adding performance enhancing race parts to cars. I probably wasted about $20,000 all together buying and replacing car parts that were perfectly fine only to want to go faster and adding gears, carburetors, cams, pistons, nitrous oxide, replacing engines, etc. Biggest blunder of my life.

Logging in...

What's your biggest financial blunder?

Collapse

X

-

not buying own-occupation long term disability no matter the cost

convincing myself that a Prius made sense since I drive all day and I would keep it long enough to break even on the higher cost of the car vs gas costs. Totaled two years later, honestly my fault but no on ever discussed that. I wanted a new one but I would not pull the trigger on that. Got a cheap Accent, gets almost the same mileage and it's paid for. Prius was too high of a luxury for me to do twice.

and now I can't drive, so the Prius would've been completely pointless

-

-

Originally posted by QuarterMillionMan View PostWhat is your biggest financial blunder? For me it was hot rodding, modifying and adding performance enhancing race parts to cars. I probably wasted about $20,000 all together buying and replacing car parts that were perfectly fine only to want to go faster and adding gears, carburetors, cams, pistons, nitrous oxide, replacing engines, etc. Biggest blunder of my life.

I see that now your hooked up with lady fotuna, she won't break your heartretired in 2009 at the age of 39 with less than 300K total net worth

Comment

-

-

Bought a house at the height of the market in 2006 at 23 years old on an interest-only ARM with a second mortgage, and the house needed a lot of work. Live and learn. It's how I originally found my way to SA and started turning things around. I managed to save for retirement during that time, but all in all, it represents a good 5-7 years of financial setback from a cash and equity perspective.History will judge the complicit.

Comment

-

-

Similar to ua guy. We bought a house we couldn't afford near the top of the bubble. We moved across the state just as the bubble was beginning to burst. Couldn't sell the house. That's what brought me here to SA.

We ended up selling the house as a short sale, after a few years and a lot of pain.

Comment

-

-

Completely my own fault, but not reading the papers I was signing and not asking questions on things I really didn't understand many years ago (like back in the 90's) when we did a mortgage refi because I didn't want them to think I was too stupid to know what was going on.

Honestly I was so dumb but way back in those days our mortgage company (Countrywide) just called up out of the blue and told me we could lower our mortgage monthly payment by whatever amount. No problem. They'd just get all the papers together and we just had to go in and sign them. I was all like "Oh that's so cool" and everything. The guy talked really fast and I as a new college graduate didn't want to seem stupid. And my husband followed my lead.

I ended up with a home equity loan that I didn't want and never should have signed and stretched our under 15 years left mortgage out to a brand new 30 years. I can't remember what the rate on that home equity line was but it was higher than our credit cards. It was like our old mortgage balance was around $75,000 and they put $15,000 on a home equity line of credit at some double digit interest rate and then $60,000 on the new 30 year mortgage. Blech. I was so dumb just to follow along with them. And our mortgage payment WAS lower because that home equity line had no required payments at all for the first 6 months. They just so kindly kept adding interest into our balance and not making us pay. LOL

I had to surf low rate balance transfer credit cards for a couple of years getting it paid down. So the lesson learned:

1. You look a lot stupider to the fast talking bankers when you just smile and sign their lousy deal that you really don't understand than you would look if you opened up your mouth and said "Wait. I don't understand what this is, somebody explain it to me logically or I'm not signing."

and

2. Be wary of people who just call up out of the blue with wonderful mortgage refinances.

Comment

-

-

First thing that comes to mind is being talked into a whole life policy many years ago. Fortunately, I wised up and cancelled it a few years later. Even more fortunately, there was a huge class action lawsuit against the industry for misrepresenting whole life policies as investments. When that case was settled, I got back everything I had paid in.

The sad part is that absolutely nothing has changed as a result of that lawsuit. Whole life is still sold as an investment vehicle, as we so often see with threads right here. I wish that lawsuit would have brought about change in the field but sadly it did not.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

I bought my house in 2006 so I overpaid (by about 15k based on today's value) due to market conditions.

I'm great at picking stocks but I didn't buy them due to second guessing myself (SIRI sub 0.25; NFLX in 2006; FB at ~$18 are a few that come to mind).

Wish I had realized power of Dollar Cost Averaging/adding to stock positions when I first started investing in my taxable account in 2004.

And I should have also done investing in my ROTH account instead of holding CDs for a few years.

there are probably others that I've buried deep in my memory...

oh well...

Comment

-

-

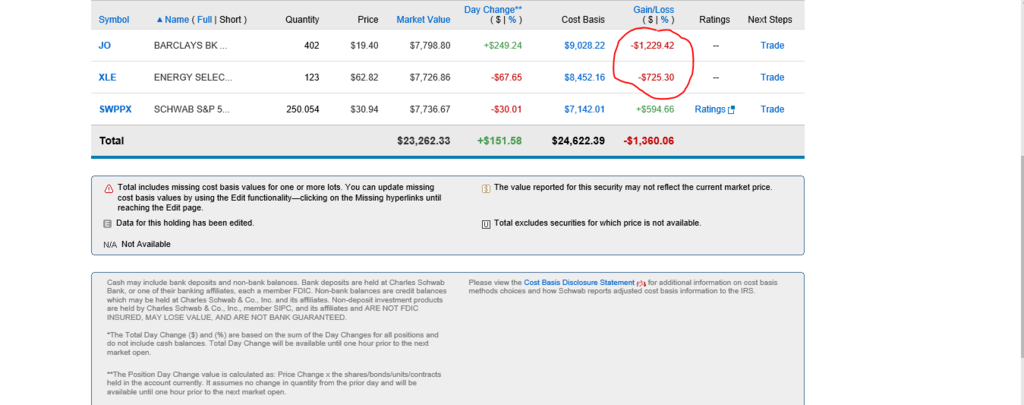

Just before the most recent volatility in the stock market beginning on August 14, 2015, I was sitting on $22,000 of uninvested cash funds and thinking that I had been missing out on the stock market gains. So on August 10, 2015, I invested half of it in the ETF in coffee, JO. And the other half I invested in the ETF in the energy select SPDR, XLE. As you can see to date I lost $2000 of it combined. I'm not out of the woods yet but at least bleeding has slowed a bit. The coffee ETF is very volatile as you can see that just today I made back $249 but still at an overall loss.

Comment

-

-

Not paying enough attention to my 401k early enough.

We also bought our first home at the height of the market and now rent it out. It may not have been the best move financially, but I don't consider it a blunder since we were well within our means on the house and still ended up cheaper than renting would have been, plus it gave us a roof over our heads that we loved being in.

Comment

-

-

I got talked into a timeshare YEARS ago. Wasn't expensive $2k? But the real money suck was the annual fee to "keep" and use it. And we never used it. OMG biggest waste of money. We couldn't give it away until finally I found a company willing to take it. It only took me many years I'm still trying to figure out how many years.

But can I get a slap upside the head for that mistake? I think the fee was $300/year. The stupidity of it still rubs me the wrong way.

Comment

-

-

$300/year is cheap...consider yourself lucky. My in laws bought one for $15k and the annual fee was around $600 - $700. Luckily they only had it for maybe 6 years...had to get an attorney to get rid of it. One of their biggest financial blunders.Originally posted by LivingAlmostLarge View PostI got talked into a timeshare YEARS ago. Wasn't expensive $2k? But the real money suck was the annual fee to "keep" and use it. And we never used it. OMG biggest waste of money. We couldn't give it away until finally I found a company willing to take it. It only took me many years I'm still trying to figure out how many years.

But can I get a slap upside the head for that mistake? I think the fee was $300/year. The stupidity of it still rubs me the wrong way.

Comment

-

Comment