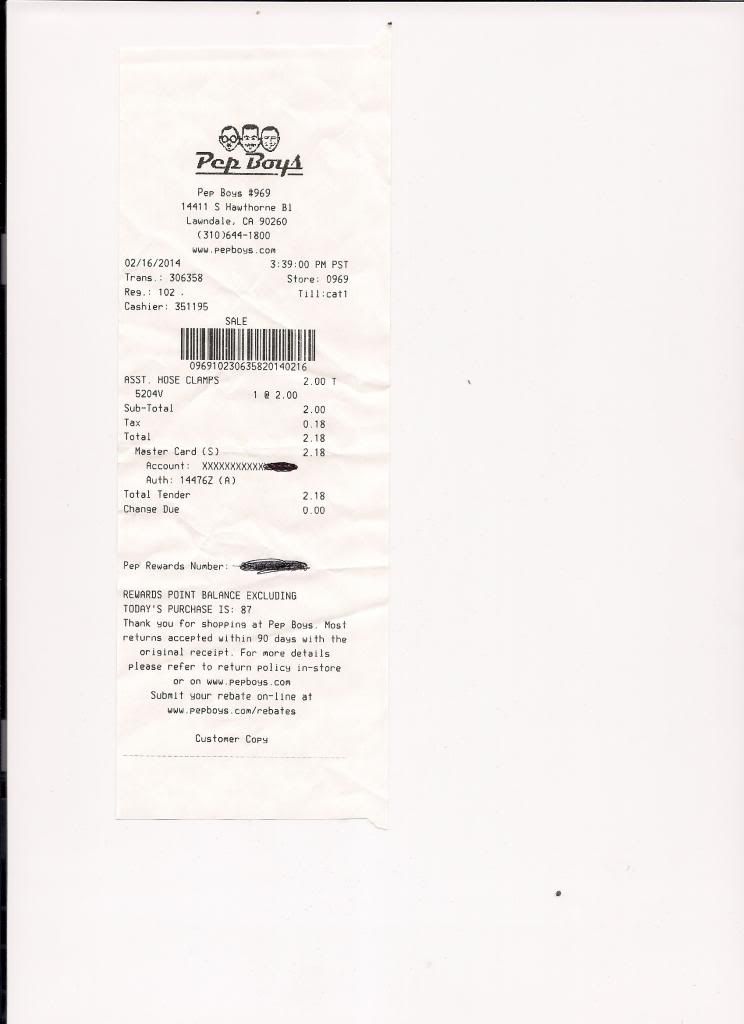

Close to 10% in Los Angeles. However we do get a break on food which incurs no tax. When I lived in Hawaii sales tax was only 4% there, now it's 4.5% there when voters approved to install a lite rail system which I consider a waste of money. Anyway how much is sales tax in your area?

Logging in...

How much is sales tax in your state?

Collapse

X

-

8.5% in my Northern California City - they just bumped it up considerably in past year. Maybe 7.75 before.

No sales tax on food, so I feel pretty "meh" about it, since we mostly buy food. & used goods. It sucks when you buy a car (new or used). This could be one reason why we keep our cars for a LONG time (& are careful on not paying a large amount in the first place).

To be clear, dining out is taxed, which is something else we rarely do. & why eating in can be a LOT cheaper.

Comment

-

-

8.3%-8.5% in most of the Oklahoma City metro area... 4.5% state sales tax, plus another 3.8%-4% for the cities. Everybody's gotta get their dollar..... But then, I can only begrudge them the sales tax so much though...property & income taxes are reasonable, and overall Oklahoma is one of the lowest COLA's in the country.

However, having grown up in Guam where there is no sales tax, I still find it bothersome. In my opinion, vendors should just include taxes in the stated price of an item & be done with it. It's annoying that I go to the store, buy a $10 item, and the bill comes to some random figure between $10-$11. Everywhere else in the world that I've traveled (Japan, Europe, Australia, Korea, Middle East, and so on) just includes the taxes in the listed price, and it's as simple as that. Bad form, America.

Comment

-

-

Here's a chart of all the rates:http://www.salestaxinstitute.com/resources/rates

Keep in mind that the question can't just be what is the rate in your state but rather what is the rate in your town? Rates vary by municipality.

In NJ, the state rate is 7%.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

Tax on food in my area is 5.391%, unless at a restaurant, in which case it is an additional 1%. I think there is an another additional tax on drive-through food; not totally sure.

Tax on general merchandise is 8.679%.

However, there are some 200 "special taxing districts" where merchants are allowed to charge an extra 1% and that tax money can be used by private companies (owners of the buildings, really) to use for security, public trash cans, lighting, etc, or to pay for the city to give extra attention to surrounding streets. Sometimes the special taxing districts consist of a single building. I am only knowledgeable about a couple of the districts, so do not know when I might randomly shop in one.

Mostly we do not have tax on services, but there are some exceptions.

The general merchandise tax was removed from prescription medicines about 15 years ago, I think. Now there is no tax on them."There is some ontological doubt as to whether it may even be possible in principle to nail down these things in the universe we're given to study." --text msg from my kid

"It is easier to build strong children than to repair broken men." --Frederick Douglass

Comment

-

-

There are some towns designated as "urban enterprise zones" where the sales tax is only 3.5% to spur business and reduce the burden on the poor residents of those areas.Originally posted by disneysteve View PostIn NJ, the state rate is 7%.Steve

* Despite the high cost of living, it remains very popular.

* Why should I pay for my daughter's education when she already knows everything?

* There are no shortcuts to anywhere worth going.

Comment

-

-

6% in Iowa, but we have counties that have voted in a Local Option Sales Tax, which goes to the municipalities in the county. That increases the sales tax in our town to7%. No tax on most food, and services. The are exceptions.My other blog is Your Organized Friend.

Comment

-

Comment