Hey Guys,

On the SA user blogs, I just saw this posting:

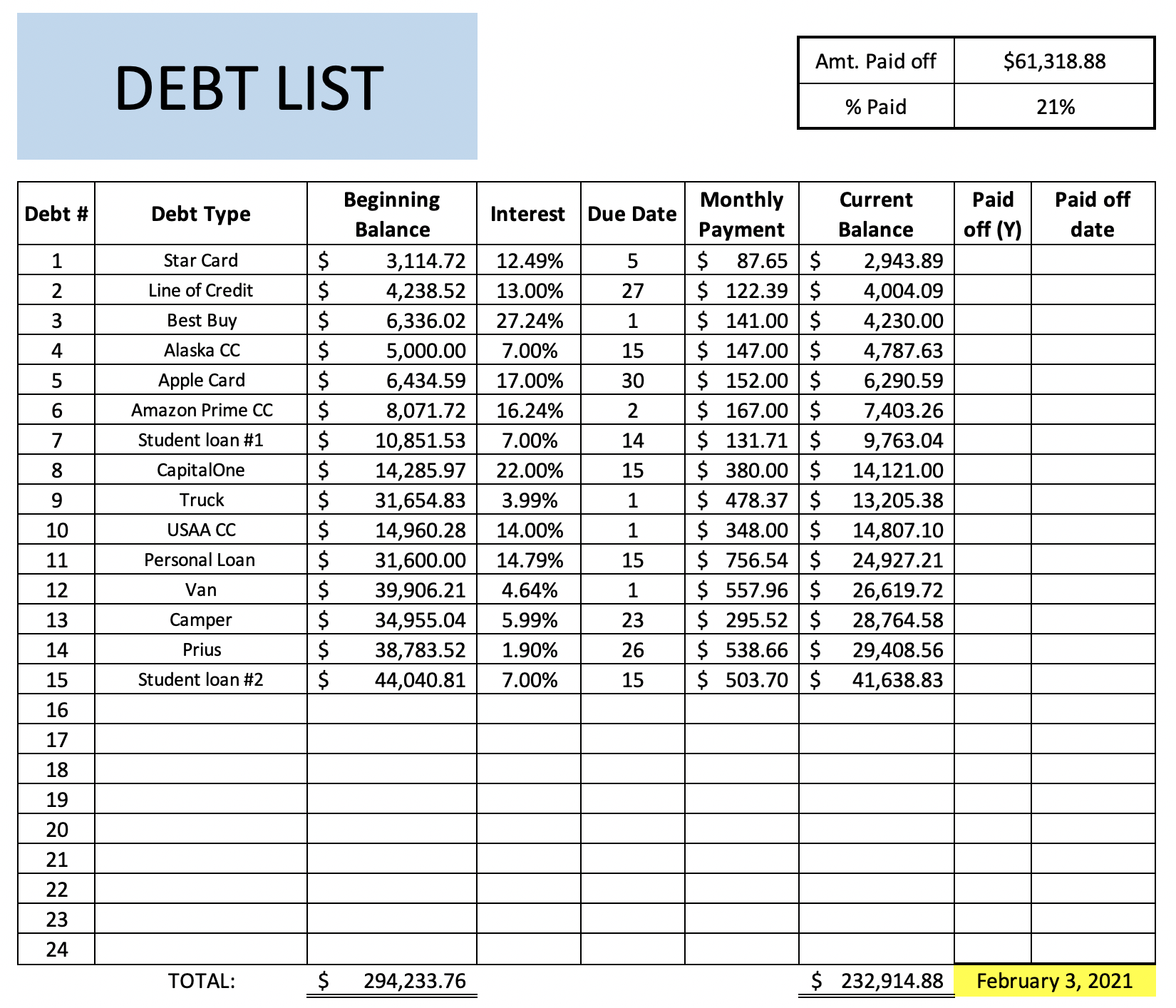

Evidently a couple in Alaska has $232,000 worth of debt, in multiple vehicle loans, some student loan debt, and some personal debt.

First, its pretty awesome that the couple is tackling this. It's sometimes a challenge to mentally face ones problems, especially large ones.

Second, what I wonder is...how does one actually accumulate that much debt?

On the SA user blogs, I just saw this posting:

Evidently a couple in Alaska has $232,000 worth of debt, in multiple vehicle loans, some student loan debt, and some personal debt.

First, its pretty awesome that the couple is tackling this. It's sometimes a challenge to mentally face ones problems, especially large ones.

Second, what I wonder is...how does one actually accumulate that much debt?

Comment