This posting is for all the lurkers here on the forums who might be skeptical about value of saving, or who feel that you can't save much money at all.

The truth is that with a bit of hustle and focus you can save money, and it adds up fast.

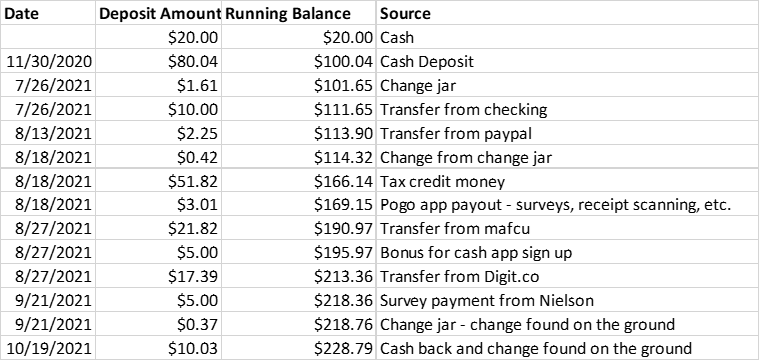

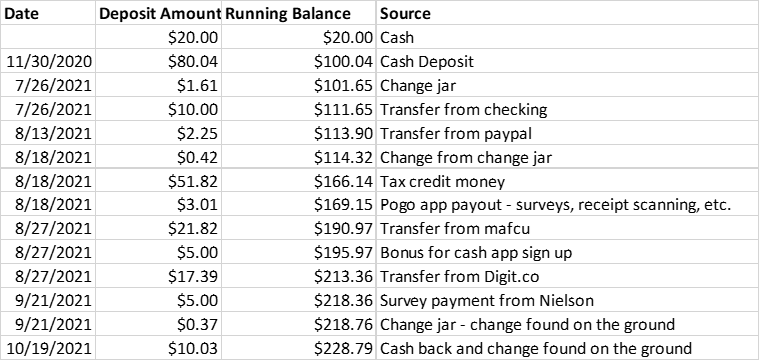

Here is a quick snapshot of my house savings account. Its pretty much from a couple of months earlier this summer. I've broken out the source of the cash, and the amount of the transaction.

My personal finances are a bit unfocused sometimes. I often have multiple goals, like paying off debt, building up passive income, maxing out my kids 529 plan contributions, or contributing to my retirement.

So, what I hit on was doing focused theme months. One month I focus on debt payoff, on another one I focus on savings, etc. So, far its been working pretty well. This info above is from my month on savings.

Pretty much I did three or four things to scrape up the cash.

1. Started saving any cash I found walking around. This has turned out to be a good approach - I'm exercising more and finding nickels and pennies. I've been regularly putting this into a savings account.

2. I've been working survey apps and cash back apps. Pogo and Google Opinion Rewards have been consistent, but low payers. I also picked up a few bucks from Nielson

3. When I have excess cash in my checking account, I move that over also. There isn't much slack in my budget, but even a few dollars is better than nothing.

4. I've been working on using coupons. On 10/19, I was able to get a coupon for $10 off a grocery order, and could add that to the savings pile.

So, the bottom line here is that if you set a goal and work on it, even small revenue streams will get you good savings results over time.

The truth is that with a bit of hustle and focus you can save money, and it adds up fast.

Here is a quick snapshot of my house savings account. Its pretty much from a couple of months earlier this summer. I've broken out the source of the cash, and the amount of the transaction.

My personal finances are a bit unfocused sometimes. I often have multiple goals, like paying off debt, building up passive income, maxing out my kids 529 plan contributions, or contributing to my retirement.

So, what I hit on was doing focused theme months. One month I focus on debt payoff, on another one I focus on savings, etc. So, far its been working pretty well. This info above is from my month on savings.

Pretty much I did three or four things to scrape up the cash.

1. Started saving any cash I found walking around. This has turned out to be a good approach - I'm exercising more and finding nickels and pennies. I've been regularly putting this into a savings account.

2. I've been working survey apps and cash back apps. Pogo and Google Opinion Rewards have been consistent, but low payers. I also picked up a few bucks from Nielson

3. When I have excess cash in my checking account, I move that over also. There isn't much slack in my budget, but even a few dollars is better than nothing.

4. I've been working on using coupons. On 10/19, I was able to get a coupon for $10 off a grocery order, and could add that to the savings pile.

So, the bottom line here is that if you set a goal and work on it, even small revenue streams will get you good savings results over time.

Comment